News

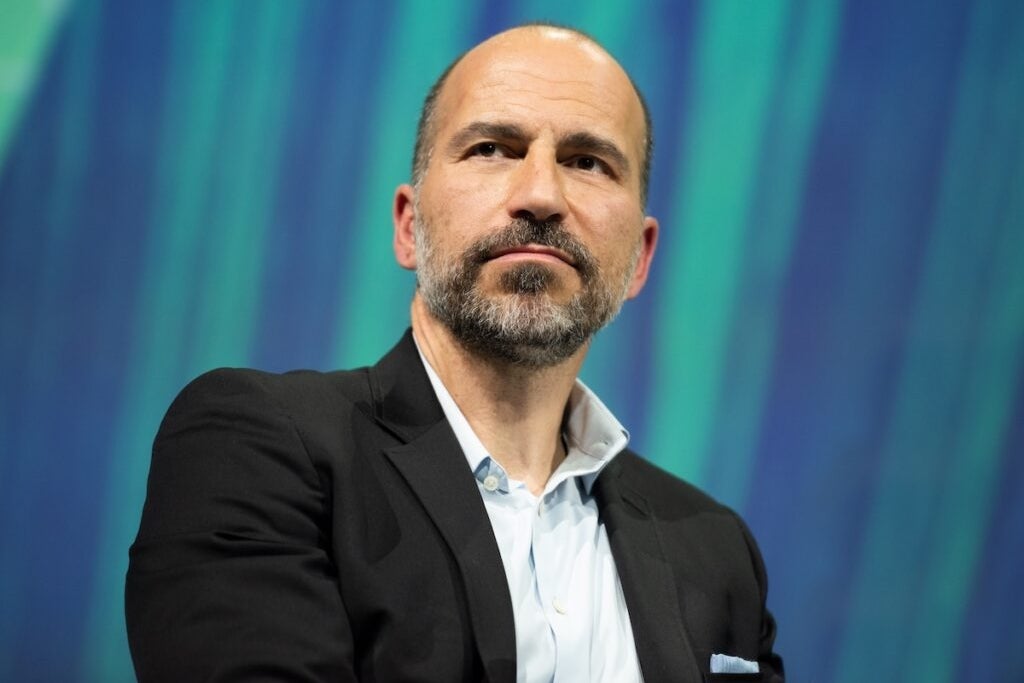

Uber CEO Welcomes Tesla’s Robotaxi Entry, But Says There Will Be No Winner-Take-All: ‘Could Be A Competitor, Could Be A Partner’

**”Uber Boss Hails Tesla’s Robotaxi Move, Predicts Thriving Coexistence”**

What’s Happening?

Uber CEO Dara Khosrowshahi has warmly received Tesla’s dive into the robotaxi market, calling it a milestone for autonomous vehicle technology. He emphasized that the industry’s vast potential accommodates both competition and teamwork, suggesting Tesla could be either a rival or a partner in the long run.

Where Is It Happening?

The discussion impacts the global autonomous vehicle industry, with implications for urban transportation markets worldwide. Both Uber and Tesla operate globally, but the immediate focus is on tech hubs like San Francisco and Austin.

When Did It Take Place?

Khosrowshahi’s remarks were made recently, underscoring the ongoing race to dominate the autonomous vehicle sector. No exact date is specified, but the context suggests a timely response to Tesla’s robotaxi ambitions.

How Is It Unfolding?

– Tesla has begun deploying robotaxis, signaling its commitment to self-driving tech.

– Uber is expanding its own autonomous vehicle division, leveraging partnerships and investments.

– Khosrowshahi views Tesla’s entry as validation of the trillion-dollar market’s potential.

– Analysts predict the future will see collaboration and competition shaping the industry.

Quick Breakdown

– Uber CEO welcomes Tesla’s robotaxi initiative.

– The autonomous vehicle market is deemed big enough for multiple players.

– Potential for both rivalry and partnership between Uber and Tesla.

– Move could accelerate innovation and adoption of self-driving technology.

Key Takeaways

Dara Khosrowshahi’s outlook reflects confidence in the autonomous driving sector’s growth. By framing Tesla’s entry as an opportunity rather than a threat, he highlights the industry’s potential for diversity and innovation. The competition among tech giants could drive faster advancements, but collaboration might prove equally beneficial in shaping the future of transportation.

The future of autonomous driving isn’t about eliminating competitors but about shaping a collective vision.

– Lisa Chen, Autonomous Tech Analyst

Final Thought

**Khosrowshahi’s optimistic stance on Tesla’s robotaxi entry sets the stage for a dynamic industry where innovation thrives. Instead of fearing competition, Uber’s CEO envisions a future of shared growth, proving that the most significant wins come from collaboration and shared vision. The autonomous driving revolution is just getting started, and the world is watching closely.**

-

New York1 week ago

New York1 week agoYankees’ Aaron Boone Makes Cody Bellinger Statement After Aaron Judge Injury

-

New York5 days ago

New York5 days agoToday in History: Investigation into Andrew Cuomo released

-

New York5 days ago

New York5 days agoSmall quake shakes the New York area. USGS says magnitude was 3.0

-

Chicago6 days ago

Chicago6 days agoESPN Provides Strong Response After Chicago Sky Pushed To ‘Shut Down’ Angel Reese

-

Austin5 days ago

Austin5 days agoWho Is Austin Drummond? What to Know About Quadruple Homicide Suspect

-

Houston5 days ago

Houston5 days agoWhy isn’t Dustin May starting on Sunday for the Red Sox?

-

Chicago4 days ago

Chicago4 days agoChicago Sky HC Makes Dissatisfaction Clear Amid 1-10 WNBA Collapse in Angel Reese’s Absence

-

Houston5 days ago

Houston5 days agoCJ Stroud’s Mom Shows Uplifting Gesture to Houston Women After Sharing Texans QB’s Struggle