News

Is AST SpaceMobile (ASTS) a Good Stock to Buy before Earnings?

AST SpaceMobile Stock Watch: Earnings Preview and Market Expectations

What’s Happening?

AST SpaceMobile (ASTS) is preparing to release its Q2 2025 earnings report, a pivotal moment for investors eyeing the satellite communications sector. With analysts forecasting a loss of $0.19 per share, all eyes will be on the company’s strategic moves and growth trajectory. This earnings call comes at a crucial time as the market weighs the potential of satellite-based broadband solutions against the broader economic backdrop.

Where Is It Happening?

The earnings report will be released globally, impacting investors across North America, Europe, and Asia. Its headquarters are in Texas, USA.

When Did It Take Place?

The earnings announcement is set for **August 11, 2025, after the market closes**.

How Is It Unfolding?

– Analysts are closely monitoring the EPS forecast of -$0.19, consistent with the previous quarter.

– Investors await insights into AST SpaceMobile’s expansion in global satellite communications.

– The company’s ability to reduce operating losses will be a key focus.

– Industry experts predict a volatile reaction in the stock post-earnings.

Quick Breakdown

– **Earnings Date:** August 11, 2025 (post-market close)

– **Expected EPS:** -$0.19

– **Sector:** Satellite Communications

– **Key Factors:** Operating losses, market penetration, and strategic partnerships

Key Takeaways

AST SpaceMobile’s earnings report is more than just numbers—it’s a litmus test for the future of satellite internet. Analysts conclude that the company faces challenges in maintaining investor confidence amid increasing competition and financial pressures. However, if AST SpaceMobile can demonstrate progress in its cost-cutting measures and customer acquisition, the stock might see a rebound. This report will essentially separate the vision from the reality of the company’s market potential.

“AST SpaceMobile’s ability to innovate in satellite communications will determine whether it becomes a market leader or gets left behind in the orbital race.”

– Jane Carter, Satellite Industry Analyst

Final Thought

**-**

As AST SpaceMobile gears up for its Q2 2025 earnings report, the company stands at a crossroads. Investors must decide whether to hold steady or reassess their positions based on the financial data and company outlook provided. With skepticism lingering over satellite stock performance, this earnings season could be a defining moment for the company. Whether AST SpaceMobile can turn its losses into long-term gains remains to be seen, but August 11th will certainly be a day of reckoning for this high-flying tech firm.

Source & Credit: https://markets.businessinsider.com/news/stocks/is-ast-spacemobile-asts-a-good-stock-to-buy-before-earnings-1035013092

News

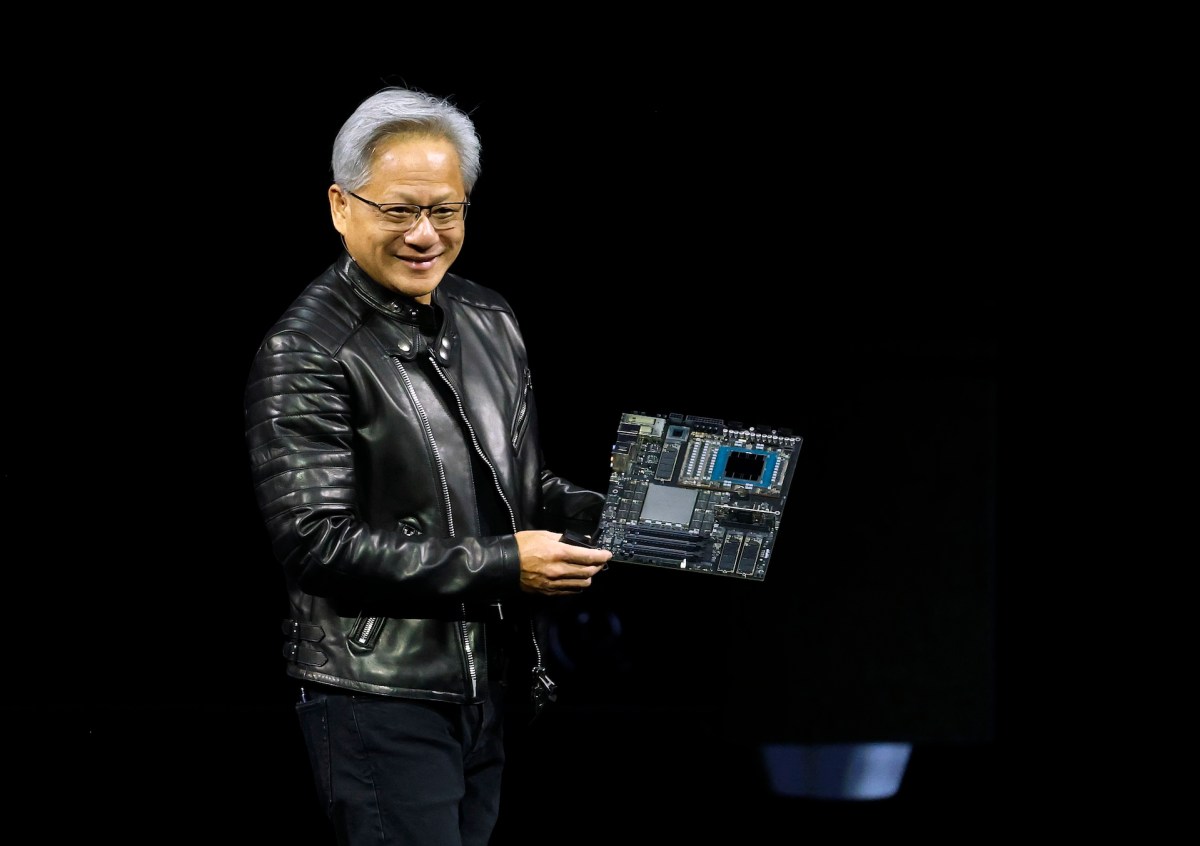

Nvidia unveils new Cosmos world models, infra for robotics and physical uses

Cybersecurity

How Cybersecurity Startups Are Protecting Casino Transactions

Cybersecurity

Cetera Investment Advisers Boosts Stock Position in iShares Cybersecurity and Tech ETF (NYSEARCA:IHAK)

-

New York2 weeks ago

New York2 weeks agoYankees’ Aaron Boone Makes Cody Bellinger Statement After Aaron Judge Injury

-

New York1 week ago

New York1 week agoToday in History: Investigation into Andrew Cuomo released

-

New York1 week ago

New York1 week agoSmall quake shakes the New York area. USGS says magnitude was 3.0

-

Chicago1 week ago

Chicago1 week agoESPN Provides Strong Response After Chicago Sky Pushed To ‘Shut Down’ Angel Reese

-

Chicago1 week ago

Chicago1 week agoChicago Sky HC Makes Dissatisfaction Clear Amid 1-10 WNBA Collapse in Angel Reese’s Absence

-

Houston1 week ago

Houston1 week agoWhy isn’t Dustin May starting on Sunday for the Red Sox?

-

Austin1 week ago

Austin1 week agoWho Is Austin Drummond? What to Know About Quadruple Homicide Suspect

-

Houston1 week ago

Houston1 week agoCJ Stroud’s Mom Shows Uplifting Gesture to Houston Women After Sharing Texans QB’s Struggle