Interest Rates

Trump’s High Interest Rate Obstacle

**Unraveling Trump’s Battle: The Low Interest Rate Conundrum**

What’s Happening?

US President Donald Trump faces an uphill battle in his push for lower interest rates, as new economic insights reveal the complexities behind adjusting the natural rate of interest. A book by Bloomberg Economics delves into the historical and contemporary challenges, highlighting the delicate balance between short-term hikes and long-term borrowing costs. This economic puzzle dates back to the early 2000s, when Fed Chairman Ben Bernanke first identified the savings glut phenomenon. Understanding this dynamic is crucial for Trump’s economic strategy.

Where Is It Happening?

This economic debate is unfolding in the United States, with implications for global financial markets and policies.

When Did It Take Place?

The origins of this debate trace back to the early 2000s and continue to be relevant in the current political and economic climate.

How Is It Unfolding?

– Bloomberg’s new book, ‘The Price of Money,’ explores the historical context of interest rate adjustments.

– Trump’s administration seeks lower rates to stimulate economic growth and borrowing.

– The natural rate of interest, a benchmark for Fed policy, remains a contentious topic.

– Treasury borrowing costs and short-term rate hikes present a balancing act for policymakers.

– Economic experts continue to analyze the long-term impacts of these policies.

Quick Breakdown

– Trump aims for lower interest rates to boost the economy.

– The natural rate of interest is a key factor in Fed policy decisions.

– Historical context from Ben Bernanke’s savings glut hypothesis is revisited.

– Balance between short-term hikes and long-term borrowing costs is crucial.

– Economic books like ‘The Price of Money’ provide new insights into these challenges.

Key Takeaways

Interest rates are intrinsic to the economy’s health and Trump’s economic vision, but lowering them isn’t as simple as it sounds. The natural rate of interest, long-term borrowing costs, and short-term rate hikes create a strategic puzzle. Understanding this intersection between history and current economic policies is vital. It’s like tinkering with a delicate see-saw – a slight nudge here can cause a dramatic shift there.

“Pursuing lower interest rates without addressing the natural rate’s fluctuations is akin to navigating a ship through a storm without a compass.”

– Tom Orlik, Bloomberg Economics Analyst

Final Thought

The quest for lower interest rates under Trump’s leadership underscores the intricate nature of economic policy. Historical lessons and contemporary challenges coalesce to form a complex landscape. Policymakers must tread carefully, balancing immediate gains with long-term stability. The economic gameplay was as intricate decades ago as it is today, and the ramifications of each move resonate far beyond the short-term.

Source & Credit: https://www.bloomberg.com/news/videos/2025-08-08/trump-s-high-interest-rate-obstacle-video

Interest Rates

A Top Federal Reserve Official Says Dour Jobs Data Backs the Case for 3 Rate Cuts

Interest Rates

A top Federal Reserve official says dour jobs data backs the case for 3 rate cuts

Interest Rates

A top Federal Reserve official says dour jobs data backs the case for 3 rate cuts

-

New York1 week ago

New York1 week agoYankees’ Aaron Boone Makes Cody Bellinger Statement After Aaron Judge Injury

-

New York1 week ago

New York1 week agoToday in History: Investigation into Andrew Cuomo released

-

New York1 week ago

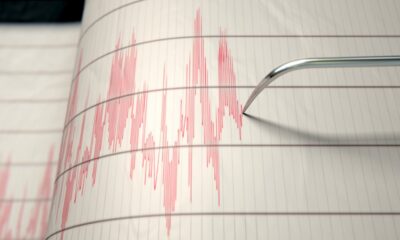

New York1 week agoSmall quake shakes the New York area. USGS says magnitude was 3.0

-

Chicago1 week ago

Chicago1 week agoESPN Provides Strong Response After Chicago Sky Pushed To ‘Shut Down’ Angel Reese

-

Chicago6 days ago

Chicago6 days agoChicago Sky HC Makes Dissatisfaction Clear Amid 1-10 WNBA Collapse in Angel Reese’s Absence

-

Austin1 week ago

Austin1 week agoWho Is Austin Drummond? What to Know About Quadruple Homicide Suspect

-

Houston7 days ago

Houston7 days agoWhy isn’t Dustin May starting on Sunday for the Red Sox?

-

Houston1 week ago

Houston1 week agoCJ Stroud’s Mom Shows Uplifting Gesture to Houston Women After Sharing Texans QB’s Struggle