Dow Jones

Nasdaq Ends the Week at a New High: Stock Market Today

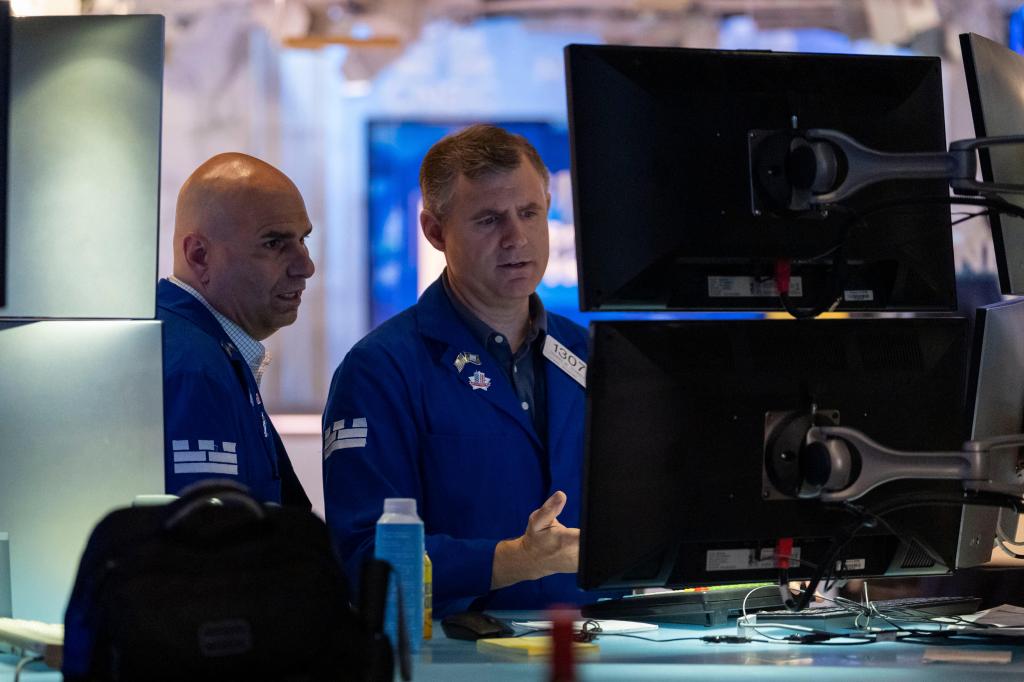

**Nasdaq Hits New High; S&P 500 Narrowly Misses Record**

What’s Happening?

The Nasdaq surged to a new all-time high on Friday, leading the stock market’s weekly climb. The S&P 500 nearly reached a record, while the Dow Jones still waits for its 2025 peak. Investors enjoyed strong daily and weekly gains despite a quiet economic calendar, focusing on ongoing market momentum.

Where Is It Happening?

The gains are being seen across major U.S. stock exchanges, particularly impacting technology-heavy indices like the Nasdaq.

When Did It Take Place?

The surge occurred on Friday, marking a week of significant market advancements.

How Is It Unfolding?

– Nasdaq closes at a historic high, driven by tech stock performance.

– S&P 500 nears its own record, showing broad market strength.

– Dow Jones lags behind, yet to achieve a fresh peak in 2025.

– Investors eye potential economic indicators for the coming week.

– Market sentiment remains optimistic despite scant economic data.

Quick Breakdown

– Nasdaq hits new all-time high on Friday.

– S&P 500 just shy of a record close.

– Dow Jones still awaiting a 2025 peak.

– Strong weekly returns across major indices.

– Investors focused on tech and market momentum.

Key Takeaways

This week’s market performance highlights the resilience and optimism in the tech sector, particularly with the Nasdaq leading the charge. The S&P 500’s near-record close suggests broad-based strength, while the Dow’s lag implies caution among investors. The lack of significant economic news kept attention on internal market dynamics, showing how momentum and investor confidence can drive short-term gains.

The Nasdaq’s record isn’t just a milestone—it’s a testament to the tech sector’s enduring appeal. But the Dow’s hesitation reminds us that all markets move at their own pace.

– Dr. Sarah Mitchell, Market Analyst

Final Thought

**The Nasdaq’s record-high close signals a bullish pulse in the market, with technology stocks leading the way. While the S&P 500 edges closer to historical peaks and the Dow lags, investors remain hopeful. This week’s performance underscores the importance of monitoring both sector-specific and broad market trends, as economic data takes a backseat to market-driven momentum.**

Source & Credit: https://www.kiplinger.com/investing/stocks/nasdaq-ends-the-week-at-a-new-high-stock-market-today

-

New York1 week ago

New York1 week agoYankees’ Aaron Boone Makes Cody Bellinger Statement After Aaron Judge Injury

-

New York1 week ago

New York1 week agoToday in History: Investigation into Andrew Cuomo released

-

New York1 week ago

New York1 week agoSmall quake shakes the New York area. USGS says magnitude was 3.0

-

Chicago1 week ago

Chicago1 week agoESPN Provides Strong Response After Chicago Sky Pushed To ‘Shut Down’ Angel Reese

-

Chicago6 days ago

Chicago6 days agoChicago Sky HC Makes Dissatisfaction Clear Amid 1-10 WNBA Collapse in Angel Reese’s Absence

-

Houston1 week ago

Houston1 week agoWhy isn’t Dustin May starting on Sunday for the Red Sox?

-

Austin1 week ago

Austin1 week agoWho Is Austin Drummond? What to Know About Quadruple Homicide Suspect

-

Houston1 week ago

Houston1 week agoCJ Stroud’s Mom Shows Uplifting Gesture to Houston Women After Sharing Texans QB’s Struggle