News

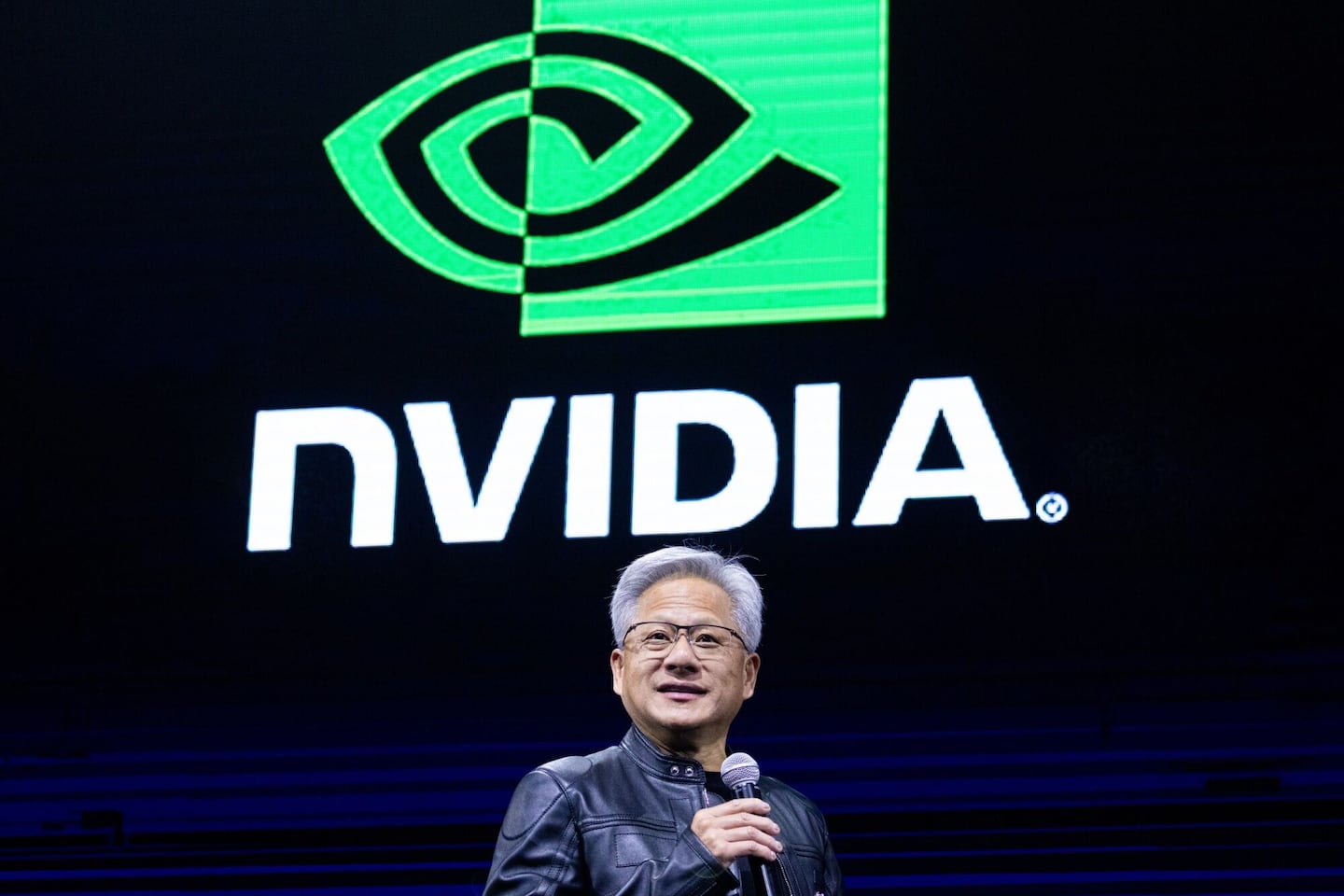

US will get a 15% cut of Nvidia and AMD chip sales to China

US taxes put a 15% cut on Nvidia and AMD chip sales to China

What’s Happening?

The U.S. has secured a deal with Nvidia and AMD, requiring a 15% cut of their chip sales to China. This arrangement is aimed at protecting American interests in the semiconductor market while still allowing sales of older chip models to China.

Where Is It Happening?

The agreement impacts global semiconductor trade, particularly between the U.S. and China, with Nvidia and AMD navigating export regulations.

When Did It Take Place?

The terms of the agreement were confirmed during a press conference earlier this week.

How Is It Unfolding?

- Nvidia and AMD must forfeit 15% of their revenue from chip sales to China.

- The arrangement was struck to secure export licenses for “obsolete” chip models.

- President Trump initially sought a 20% cut before settling for 15%.

- This deal represents a balance between U.S. national security and commercial interests.

Quick Breakdown

- The U.S. gains revenue from tech sales to China.

- Export licenses are granted for older chip models.

- Nvidia and AMD must comply with U.S. export controls.

Key Takeaways

This agreement shows how geopolitical tensions influence global tech trade. By taking a cut of chip sales to China, the U.S. aims to preserve its technological edge while allowing American companies to remain competitive. The deal highlights how sanctions and export controls are reshaping the semiconductor industry.

“Such arrangements strike a delicate balance between economic interests and national security, yet they also raise questions about long-term trust in international tech partnerships.”

– Dr. Li Wei, Semiconductor Policy Analyst

Final Thought

The U.S.’s 15% cut on Nvidia and AMD chip sales to China is a strategic move in the global tech rivalry. It ensures revenue while still allowing sales, but long-term implications for U.S.-China tech relations remain uncertain. This deal is a clear sign that the semiconductor industry will keep evolving under geopolitical pressures, with companies caught in the middle.

Source & Credit: https://www.bostonglobe.com/2025/08/11/business/nvidia-amd-ai-chips-china/

-

New York2 weeks ago

New York2 weeks agoYankees’ Aaron Boone Makes Cody Bellinger Statement After Aaron Judge Injury

-

New York1 week ago

New York1 week agoToday in History: Investigation into Andrew Cuomo released

-

New York1 week ago

New York1 week agoSmall quake shakes the New York area. USGS says magnitude was 3.0

-

Chicago1 week ago

Chicago1 week agoESPN Provides Strong Response After Chicago Sky Pushed To ‘Shut Down’ Angel Reese

-

Chicago1 week ago

Chicago1 week agoChicago Sky HC Makes Dissatisfaction Clear Amid 1-10 WNBA Collapse in Angel Reese’s Absence

-

Houston1 week ago

Houston1 week agoWhy isn’t Dustin May starting on Sunday for the Red Sox?

-

Austin1 week ago

Austin1 week agoWho Is Austin Drummond? What to Know About Quadruple Homicide Suspect

-

Houston1 week ago

Houston1 week agoCJ Stroud’s Mom Shows Uplifting Gesture to Houston Women After Sharing Texans QB’s Struggle