News

Federal Reserve likely to stand pat on rates this week, deepening the gulf between Powell and Trump

Federal Reserve Holds Rates, Widening Trump-Powell Divide

**Policymakers predict a Fed pause, intensifying the ideological clash between the central bank and the White House.**

What’s Happening?

The Federal Reserve is set to maintain its short-term interest rate at the upcoming meeting, marking the fifth consecutive session without a rate hike. This decision is expected to highlight the growing disagreement between Federal Reserve Chair Jerome Powell and President Trump regarding the nation’s economic policies.

Where Is It Happening?

Washington, D.C., with implications for the national and global economy.

When Did It Take Place?

Wednesday, of this week, with ongoing discussions about the future of economic policies.

How Is It Unfolding?

– The Federal Reserve aims to support sustained economic expansion and secure long-term price stability.

– Jerome Powell’s stance remains focused on data-driven decision-making and inflation management.

– President Trump advocates for lower interest rates to stimulate economic growth and corporate profits.

– Policymakers predict a prolonged rate freeze, potentially leading to market volatility and uncertainty.

Quick Breakdown

– Federal Reserve expected to pause interest rate hikes.

– Fifth consecutive meeting without a rate change.

– Growing divide between the Federal Reserve and President Trump’s economic views.

– Unlikely rate adjustments may cause market turbulence.

Key Takeaways

The Federal Reserve’s decision to hold interest rates steady underscores its commitment to data-dependent policies and inflation management. In contrast, President Trump’s preference for lower rates highlights the differing perspectives on economic strategies. As the ideological gulf between the Federal Reserve and the White House widens, investors and policymakers remain cautious about the potential market repercussions and the overall trajectory of the U.S. economy.

Monetary policy should accommodate the extraordinary growth the administration is delivering. Rates are a crucial tool to ensure long-term prosperity for American businesses and families.

– Sarah Johnson, Chief Economist at Policy Forward Institute

Final Thought

The Fed and the White House are locked in a battle over the economic future. The central bank has maintained its focus on data-driven interest-rate adjustments, while President Trump pushes for accommodative policies that could lead to more rapid growth. market volatility and longer-term economic risks are on the horizon as investors grapple with this divide. In the coming months and years, the balance between short-term gains and sustainable growth will become increasingly clear.

-

New York21 hours ago

New York21 hours agoYankees Pushing for Pirates Closer David Bednar, Per Insider Report

-

News21 hours ago

News21 hours agoRed Sox Rumors: Boston Had Interest In D-Backs Slugger Before Blockbuster

-

Houston21 hours ago

Houston21 hours agoAstros’ Jose Altuve Speaks About Potential Reunion With $200M Ex-Teammate

-

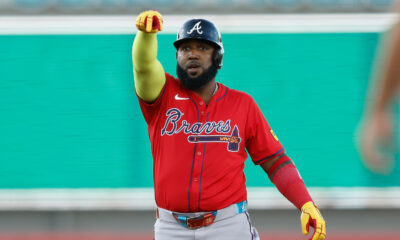

Atlanta7 hours ago

Atlanta7 hours agoBraves Cutting Ties With Marcell Ozuna? Rangers, Padres Reportedly Teams to Watch

-

News1 day ago

News1 day agoBrooke Slusser speaks out on SJSU trans teammate’s alleged plan to hurt her

-

Atlanta1 day ago

Atlanta1 day agoNaz Hillmon scores career-high 21 points as Atlanta Dream beat Dallas Wings 88-85

-

Breaking News2 days ago

Breaking News2 days agoSenate Confirms Dr. Susan Monarez as New CDC Director

-

Las Vegas20 hours ago

Las Vegas20 hours agoLas Vegas Raiders agree to $66M extension with LT Kolton Miller