News

Dallas investor sues Silicon Valley figure, top Stanford official for fraud

Dallas Investor Sues Silicon Valley Star, Stanford VP Over Alleged Fraud

Imagine investing your life savings in a promising business venture, only to discover it was all a mirage. That’s the grim reality Dallas real estate executive Jared Caplan finds himself in, as he sues prominent Silicon Valley figure Philip McCrea and Stanford’s Vice President of Business Affairs, Andy S. Tech, alleging a sophisticated fraud scheme.

What’s Happening?

Jared Caplan is suing Philip McCrea and Andy S. Tech, claiming they lured him into investing in Home Care Assistance, an in-home health care service, with false promises of growth and profitability.

Where Is It Happening?

The case is being tried in Dallas, Texas, involving parties based in Dallas and Silicon Valley.

When Did It Take Place?

The initial investment was made in 2015, with the lawsuit filed recently.

How Is It Unfolding?

- Caplan alleges McCrea and Tech promised significant support and resources for his investment.

- He claims the defendants failed to deliver on promises, leading to substantial financial losses.

- The lawsuit argues the investment opportunity was a “bait-and-switch” scheme.

- Both defendants have denied the allegations, claiming Caplan was aware of the risks.

- The trial is expected to delve into the intricate details of the investment agreement and communications between the parties.

Quick Breakdown

- Plaintiff: Jared Caplan, Dallas real estate executive.

- Defendants: Philip McCrea (Silicon Valley figure), Andy S. Tech (Stanford VP of Business Affairs).

- Company in question: Home Care Assistance, an in-home health care service.

- Investment year: 2015.

- Allegations: Fraud, bait-and-switch scheme, breach of contract.

Key Takeaways

This case highlights the potential risks and complexities of franchise investments. It underscores the importance of thorough due diligence and clear communication between investors and franchisors. Caplan’s lawsuit serves as a cautionary tale for investors, emphasizing the need to verify promises and understand the terms of investment agreements fully.

Franchise investments can be lucrative, but they require careful scrutiny and a clear understanding of the agreements involved. This case is a stark reminder of the potential pitfalls.

– Linda Greenbaum, Franchise Law Expert

Final Thought

This lawsuit is a stark reminder for investors to approach franchise opportunities with caution. Clear communication, thorough due diligence, and a comprehensive understanding of investment agreements are crucial to mitigate risks. As Caplan’s case unfolds, it will likely shed light on the intricacies of franchise investments and the importance of transparency between all parties involved.

-

News1 day ago

News1 day agoRed Sox Rumors: Boston Had Interest In D-Backs Slugger Before Blockbuster

-

New York1 day ago

New York1 day agoYankees Pushing for Pirates Closer David Bednar, Per Insider Report

-

Houston1 day ago

Houston1 day agoAstros’ Jose Altuve Speaks About Potential Reunion With $200M Ex-Teammate

-

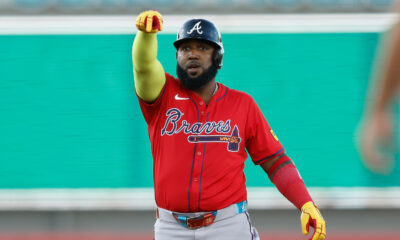

Atlanta14 hours ago

Atlanta14 hours agoBraves Cutting Ties With Marcell Ozuna? Rangers, Padres Reportedly Teams to Watch

-

News1 day ago

News1 day agoBrooke Slusser speaks out on SJSU trans teammate’s alleged plan to hurt her

-

Atlanta1 day ago

Atlanta1 day agoNaz Hillmon scores career-high 21 points as Atlanta Dream beat Dallas Wings 88-85

-

Breaking News3 days ago

Breaking News3 days agoSenate Confirms Dr. Susan Monarez as New CDC Director

-

News1 day ago

News1 day agoCruz Azul vs. Seattle Sounders: Leagues Cup preview, odds, how to watch, time