News

BKNG, TSMC, and CAT: The 3 Stocks Immune to This Year’s Market Volatility

Scorching Summer for Markets: Stocks Standing Tall Amid Volatility

What’s Happening?

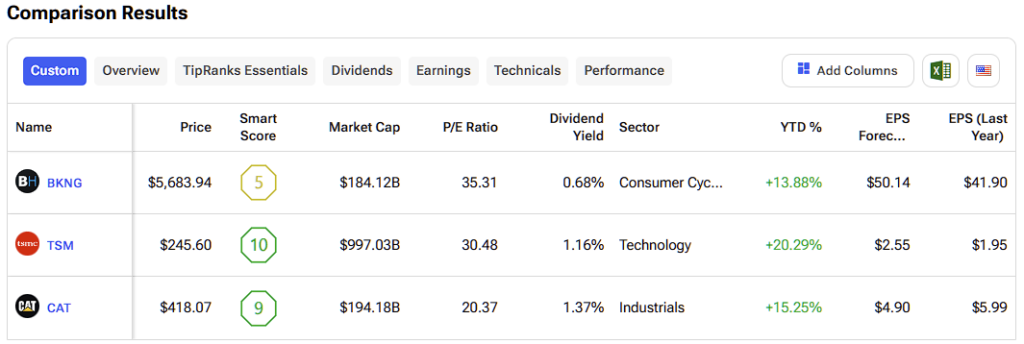

Amid relentless market volatility, three stocks have shown remarkable resilience. Booking Holdings, TSMC, and Caterpillar defy the overall market downturn, driven by unique strengths and global demand. Investors are flocking to these safe havens amidst the storm.

Where Is It Happening?

The resilience is evident across global markets, with impacts notably felt in the U.S. and Asia due to trade tensions and geopolitical risks.

When Did It Take Place?

This trend has been shaping up through the first half of 2025, particularly after June when U.S.-China tariffs hit a historic high.

How Is It Unfolding?

- BKNG surges on strong travel demand, proving resilient as consumers prioritize experiences.

- TSMC thrives amid global chip scarcity, benefiting from increased tech manufacturing needs.

- CAT sees gains as infrastructure projects gain momentum worldwide to offset geopolitical shocks.

- Investors pivot to these stocks due to their stability and growth prospects in uncertain times.

Quick Breakdown

- U.S.-China tariffs clocked at 15.8% by June 2025, highest since 1936.

- TSMC capitalizes on the semiconductor shortage, reporting record sales.

- CAT’s stock rises with government stimulus focusing on infrastructure.

- Travel demand boosts BKNG’s performance, outpacing market expectations.

Key Takeaways

In volatile markets, compelling stories such as a shift towards experiential travel, a global chip shortage, and infrastructure revamping are what softened the blow these particular equities received. These themes are proving to defensively secure assets and growth potential amid broader uncertainties. The tariffs heightened trade tensions, which usually signal slower growth, but savvy investors can zoom in on companies thriving despite obstacles.

Markets will always see turbulence, but stocks like BKNG, TSMC, and CAT remind us of the importance of resilience and adaptability.

– Sarah Lin, Market Analyst at Global Finance Insights

Final Thought

**With global instability significantly impacting market stability in 2025, Bookings Hardware, TSMC, and Caterpillar prove faith in risk-mitigation investing. These companies leverage strong fundamentals to flourish amid market tumult. As U.S.-China tensions continue, investors prioritize companies that tap into essential services, technological needs, and infrastructure, highlighting their intrinsic value.**