Business

Brazil’s Lula speaks with China’s Xi on BRICS, bilateral opportunities

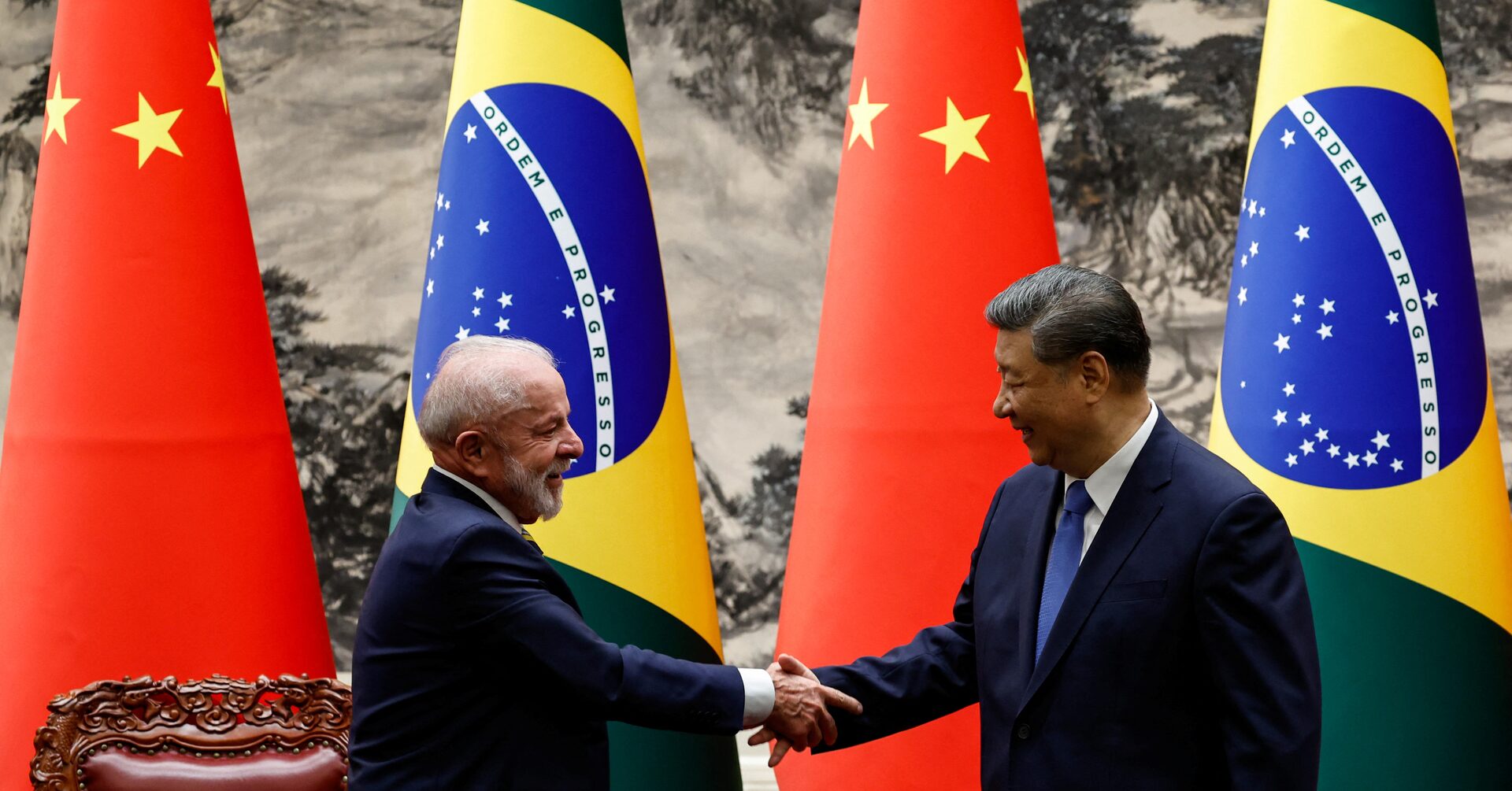

**Lula and Xi Discuss BRICS Expansion and Future of Bilateral Trade**

What’s Happening?

Brazilian President Luiz Inácio Lula da Silva held a significant one-hour conversation with Chinese President Xi Jinping, focusing on strengthening ties within the BRICS alliance and exploring business opportunities. The discussion highlighted Brazil’s strategic engagement with China, its largest trading partner, showcasing Lula’s diplomatic efforts to bolster economic and political collaboration.

Where Is It Happening?

The talks occurred remotely between Brazil and China, with both presidents leading their respective countries from their official residences.

When Did It Take Place?

The meeting took place on Monday, though no specific date was released, indicating recent developments in bilateral relations.

How Is It Unfolding?

– Both leaders emphasized the importance of BRICS in shaping global economic policies.

– Bilateral trade opportunities were highlighted, potentially diversifying Brazil’s economic partnerships.

– The conversation underscored shared goals in addressing global challenges such as climate change and infrastructure.

-jsxjdx gg

– Brazil aims to strengthen its position within BRICS, positioning itself as a key player in emerging economies.

Quick Breakdown

– Lula and Xi talked for one hour about economic and political collaboration.

– Both leaders reaffirmed the importance of BRICS in global economic governance.

– The discussion covered bilateral trade, with China being Brazil’s top trade partner.

– Shared interests in climate action and infrastructure were also explored.

Key Takeaways

This dialogue marks a critical step in Brazil’s efforts to balance its global alliances while securing economic stability. By reinforcing ties with China, Brazil is positioning itself as a pivotal player in both regional and global markets. The focus on BRICS expansion reflects a shared vision for a more multipolar world, challenging traditional economic hegemony. As geopolitical tensions rise, these alliances could redefine trade routes and economic strategies for years to come.

“The future of BRICS lies in the collective strength of its members to challenge and reshape global economic norms.”

– Ana Costa, Trade Analyst

Final Thought

**The conversation between Lula and Xi is more than just a diplomatic formality—it’s a strategic move to enhance Brazil’s global standing and economic resilience. As BRICS continues to expand, this alliance could redefine global trade, offering emerging economies a stronger voice in international affairs.**

Source & Credit: https://www.reuters.com/world/china/brazils-lula-speaks-with-chinas-xi-brics-bilateral-opportunities-2025-08-12/