News

Buffett Missed The AI Boom: Is He Just Warming Up For The Bust?

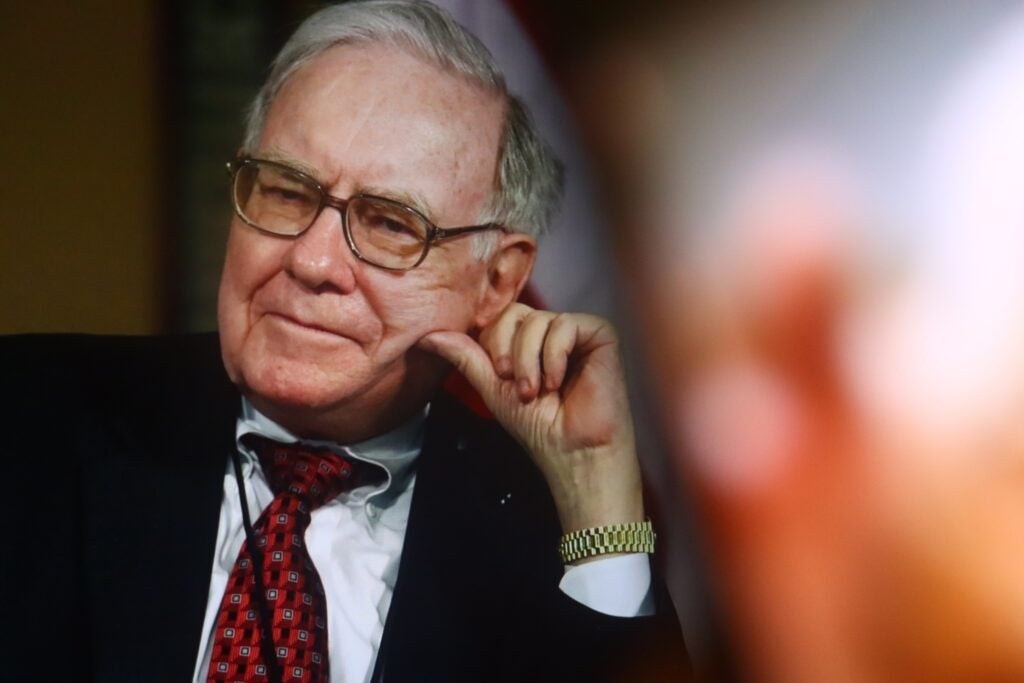

**Warren Buffett’s Patience Pays as AI Boom Overshadows Berkshire’s Gains**

What’s Happening?

Warren Buffett’s Berkshire Hathaway is lagging behind the S&P 500 by a staggering 26%, the largest gap in decades. Is the Oracle of Omaha sitting on the sidelines as AI-driven stocks soar, or is he strategically positioning for a market downturn? This move has sparked debates among investors.

What’s Happening?

Warren Buffett’s Berkshire Hathaway underperforms against the S&P 500 during the AI boom, raising questions about his investment strategy ahead of his retirement announcement.

Where Is It Happening?

Primarily affecting global financial markets, with Berkshire Hathaway’s portfolio under scrutiny amidst the U.S. tech sector’s AI-driven rally.

When Did It Take Place?

The divergence became pronounced following Buffett’s retirement announcement in May, as the AI surge gained momentum.

How Is It Unfolding?

- Berkshire Hathaway trails the S&P 500 by a record 26%, driven by a lack of exposure to AI growth stocks.

- The company seems to be sitting on substantial cash reserves instead of chasing the market rally.

- Buffett’s hesitation hints at a potential market correction, aligning with his historical strategy.

- Analysts dissect whether this is a missed opportunity or a calculated move.

- Long-term investors debate the value of Buffett’s no-risk approach amidst speculative AI investments.

Quick Breakdown

- Berkshire’s S&P 500 underperformance stands at 26%—highest ever recorded.

- Buffett’s no-AI stance contrasts sharply with market winners like Nvidia and Microsoft.

- The firm holds significant cash, signaling caution and readiness for market downturns.

- Experienced investors back Buffett, citing his long-term vision over short-term AI gains.

Key Takeaways

Warren Buffett’s decision to avoid AI-driven stocks while accumulating cash could be a high-stakes gamble. If the AI bubble bursts, Berkshire may emerge as a prime buyer at fire-sale prices. Conversely, if AI continues its dominance, Buffett risks missing out on further gains. Buffett’s strategy speaks to his deep belief in market cycles, but the real test comes from the tech sector’s performance in the coming quarters. Investors are split—some champion his foresight, while others question whether he’s falling behind the curve.

Tempestuous times require stable anchors, and Buffett is taking no shortcuts. Too bad the market seems to be skipping ahead.

Anna Park, Portfolio Manager

Final Thought

Buffett might be missing the AI boom, but history shows he often profits when others overreach. Whether this is restraint or reluctance remains to be seen, but one thing’s certain—Berkshire’s cash hoard could signal a seismic shift in the stock market sooner than expected.

Source & Credit: https://www.benzinga.com/markets/equities/25/08/46911327/buffett-misses-the-ai-boom-but-is-he-just-warming-up-for-the-bust