Credit Card

Credit Card Perks 2.0: Experiences, Sustainability And Perks Win Gen Z

**Gen Z Redefines Credit Card Perks with Experience and Sustainability Focus**

What’s Happening?

Generation Z is transforming the credit card industry by prioritizing unique experiences, sustainability, and personalized benefits over traditional rewards. Unlike older generations, Gen Z seeks cards that align with their values and lifestyle, pushing issuers to innovate.

Where Is It Happening?

This shift is occurs globally, particularly in regions with a strong digital-savvy population, including North America, Europe, and parts of Asia.

When Did It Take Place?

The trend has been accelerating over the past two years as financial institutions recognize the need to cater to younger consumers’ preferences.

How Is It Unfolding?

– Credit card companies are collaborating with experience-based platforms.

– Cards with eco-friendly rewards like carbon offset contributions are gaining traction.

– Personalization and exclusivity (like special event access) are top priorities.

– Technology integration (app-based rewards, AI-driven suggestions) is crucial.

Quick Breakdown

– Gen Z prefers experiential rewards over material ones.

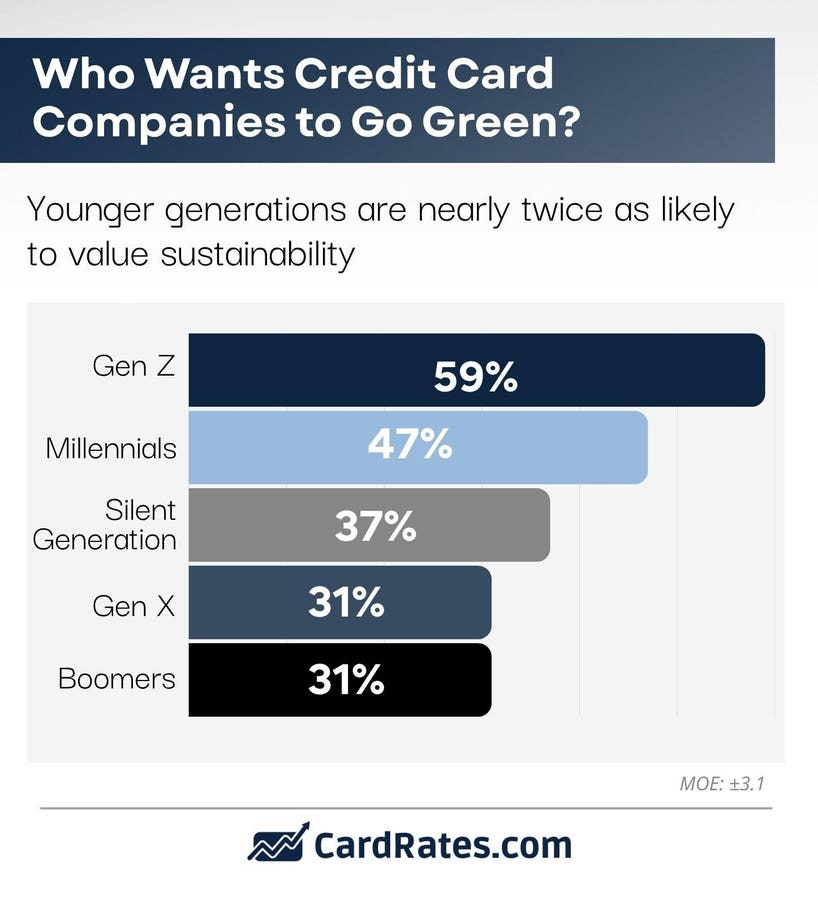

– Sustainability-focused perks are becoming a key differentiator.

– Personalized offers and digital integration enhance user engagement.

– Traditional rewards like cashback are less appealing to younger consumers.

Key Takeaways

Gen Z values credit cards that go beyond financial benefits, focusing on experiences and sustainability. They prioritize exclusivity, personalization, and digital integration. Companies that adapt by offering innovative perks will capture this tech-savvy demographic. It’s not just about saving money; it’s about adding value to their lifestyle without compromising their values. For Gen Z, a credit card is a lifestyle enhancer, not just a financial tool.

The future of credit card rewarding isn’t about points; it’s about moments that matter.

– MariaAnderson, Head of Consumer Insights, cardfuse

Final Thought

Credit card issuers must rethink their reward strategies to appeal to Gen Z. By focusing on experiences, sustainability, and personalization, they can build long-term loyalty. This shift isn’t just a trend—it’s a foundational change in how younger consumers view financial tools. Embracing innovation today will determine who leads the market tomorrow.

**

Source & Credit: https://www.forbes.com/sites/jefffromm/2025/08/18/credit-card-perks-20-experiences-sustainability-and-perks-win-gen-z/