Cybersecurity

Cyber Firm Armis Aims for 2026 IPO

**Armis Cybersecurity Eyes 2026 IPO with $300M Annual Revenue Milestone**

What’s Happening?

Cybersecurity firm Armis has crossed $300 million in annual recurring revenue, fueling its plans for a 2026 initial public offering (IPO). The surge in demand for robust cybersecurity platforms underscores the rising importance of digital defense in today’s tech-driven landscape. CEO Yevgeny Dibrov discussed the company’s growth trajectory with Bloomberg.

Where Is It Happening?

Armis is headquartered in the United States, with its operations and revenue growth spanning multiple global markets.

When Did It Take Place?

The $300 million revenue milestone was achieved recently, five years before its planned IPO in 2026.

How Is It Unfolding?

– Armis has seen a substantial increase in demand for its cybersecurity solutions.

– The company’s recurring revenue growth reflects the escalating need for advanced cyber defenses.

– CEO Yevgeny Dibrov is actively discussing the company’s potential public offering.

– Investors are closely monitoring Armis’ performance as a potential tech industry IPO.

Quick Breakdown

– Armis reaches $300M annual recurring revenue.

– IPO planned for 2026.

– Growth driven by increasing cybersecurity demands.

– CEO discusses strategy and milestones with Bloomberg.

Key Takeaways

Armis’ achievement of $300 million in annual recurring revenue marks a significant milestone in its journey toward a 2026 IPO. The surge in demand for cybersecurity platforms highlights the critical role Armis plays in protecting digital infrastructure. As businesses and governments prioritize cyber defense, the company’s growth potential is enormous. This is a strong indicator of investor confidence in the cybersecurity sector, signaling its importance in an increasingly digital world.

The cybersecurity market is on fire, and companies like Armis are at the forefront. Watch for how they navigate this surge in demand.

– Tech Analyst Review, Cyber Insights

Final Thought

Armis’ impressive revenue growth and strategic IPO planning signal a bright future for the cybersecurity market. As digital threats evolve, companies like Armis are essential in safeguarding critical data, making them valuable investments. **With a clear vision and increasing market demand, Armis’s ascension towards a 2026 IPO could set a new standard for tech startups in the cybersecurity arena.**

Cybersecurity

Hacking AI Agents-How Malicious Images and Pixel Manipulation Threaten Cybersecurity

Cybersecurity

Colorado Springs tech firm TeKnowledge laying off more than 300 employees

Cybersecurity

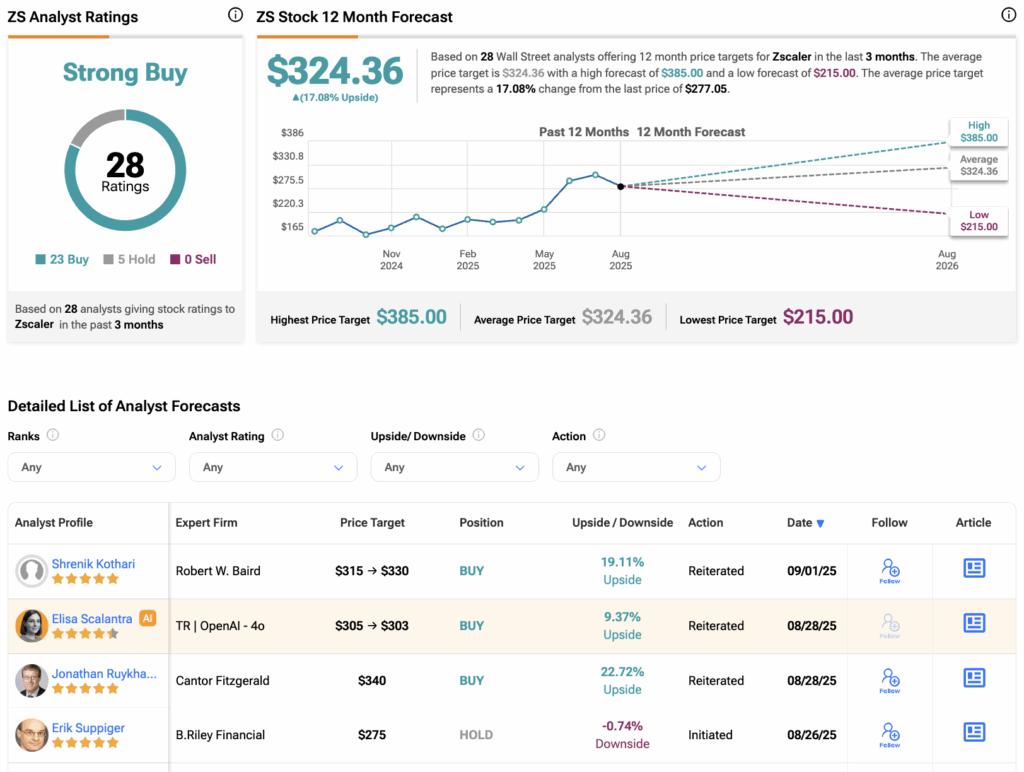

Here’s Why Morgan Stanley Turned Bullish on Zscaler Stock (ZS) Ahead of Earnings

-

GPUs2 weeks ago

GPUs2 weeks agoNvidia RTX 50 SUPER GPU rumors: everything we know so far

-

Entertainment1 week ago

‘Big Brother 27’ Contestant Rylie Jeffries Breaks Silence on Katherine Woodman Relationship

-

NASA1 week ago

NASA1 week agoNASA Makes Major Discovery Inside Mars

-

News1 week ago

News1 week ago5 Docker containers I use to manage my home like a pro

-

NASA1 week ago

NASA1 week agoNASA Peers Inside Mars And Discovers A Mysteriously Violent Martian Past

-

News1 week ago

News1 week ago“There’s a Frustration”: Chicago Sky Coach Voices True Feelings After Narrow Loss

-

News2 weeks ago

News2 weeks agoMississippi declares public health emergency over rising infant deaths. Here’s what to know

-

News1 week ago

News1 week ago4-Team Mock Trade Has Warriors Acquiring Pelicans’ $112 Million Forward, Sending Jonathan Kuminga to Suns