News

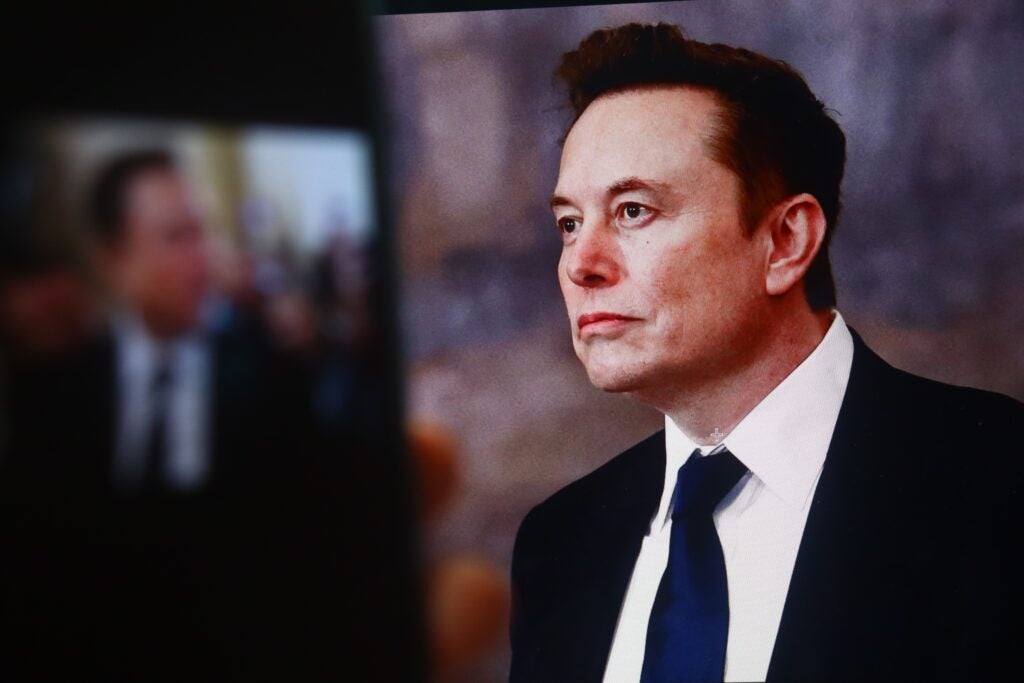

Elon Musk’s SpaceX Paid Almost No Federal Income Tax Since 2002 Despite Billions In Government Contracts: Report

SpaceX’s Tax Break Revealed: Billions in Contracts, Minimal Federal Taxes

What’s Happening?

SpaceX, Elon Musk’s pioneering space venture, has reportedly paid little or no federal income taxes since its 2002 inception. Despite securing billions in government contracts, the company leveraged tax benefits to offset its liabilities, sparking debates on corporate tax responsibilities.

Where Is It Happening?

The revelation impacts the United States, particularly the space and tech sectors, as well as federal tax policies.

When Did It Take Place?

The practices date back to SpaceX’s founding in 2002, with recent disclosures shedding light on its long-term tax strategy.

How Is It Unfolding?

– SpaceX utilized tax benefits for high-risk R&D enterprises.

– The company offset $5 billion in taxes using “net loss” rules.

– Federal contracts worth billions amplified scrutiny over tax breaks.

– Critics argue the approach underscores loopholes in corporate tax laws.

Quick Breakdown

– SpaceX paid minimal federal income taxes since 2002.

– Benefited from tax rules for R&D-intensive companies.

– Secured billions in government contracts over the years.

– Practices highlight discrepancies in corporate tax systems.

Key Takeaways

SpaceX’s tax practices raise questions about fairness, especially when balanced against public funding it has received. While legally permissible, its approach underscores the complexity of corporate tax codes and the need for reforms to ensure equitable contributions from companies of similar stature. The debate touches on the role of incentives for innovation versus societal benefit. It’s a classic tug-of-war: fostering growth versus ensuring tax equity.

“These tax strategies, though legal, blur the line between proactive business and systemic oversight gaps.”

– Dr. Linda Reed, Tax Policy Analyst

Final Thought

SpaceX’s minimal tax payments reveal a broader narrative on corporate tax policies. While the company drives innovation with taxpayer-supported contracts, the absence of federal income taxes stirs debates on fairness. The situation calls for a deeper look at how tax laws incentivize growth without overlooking public interests.

-

GPUs2 weeks ago

GPUs2 weeks agoNvidia RTX 50 SUPER GPU rumors: everything we know so far

-

NASA1 week ago

NASA1 week agoNASA Makes Major Discovery Inside Mars

-

Entertainment1 week ago

‘Big Brother 27’ Contestant Rylie Jeffries Breaks Silence on Katherine Woodman Relationship

-

News1 week ago

News1 week ago5 Docker containers I use to manage my home like a pro

-

NASA1 week ago

NASA1 week agoNASA Peers Inside Mars And Discovers A Mysteriously Violent Martian Past

-

News2 weeks ago

News2 weeks agoMississippi declares public health emergency over rising infant deaths. Here’s what to know

-

News1 week ago

News1 week agoIFA 2025: What to expect from the smart home

-

News1 week ago

News1 week agoAppeals court rules against Trump tariffs, but Supreme Court appeal may soon follow