News

Is Metallica Performing at Super Bowl LX? Lars Ulrich Says …

Rock Legends Metallica Eye Historic Super Bowl LX Showdown

What’s Happening?

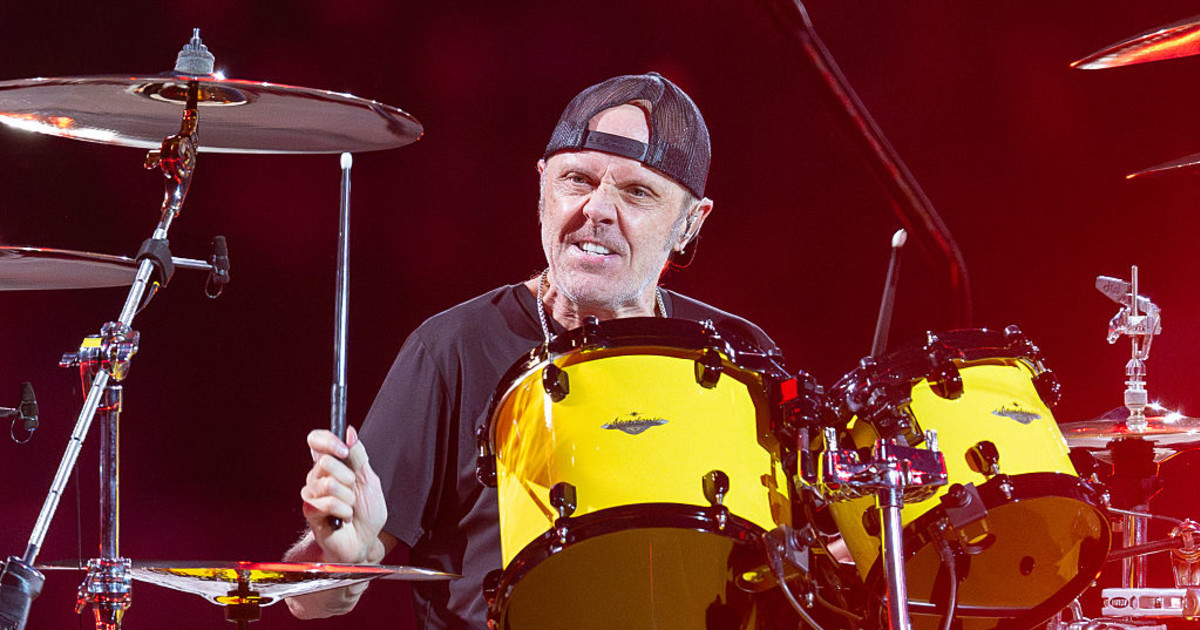

Metallica drummer Lars Ulrich has expressed his dream of performing at Super Bowl LX, reigniting speculation about the iconic rock band gracing the halftime stage in their hometown of San Francisco. Fans are buzzing with anticipation, especially since a rock band hasn’t performed at the Super Bowl since 2010.

Where Is It Happening?

The potential performance would take place in San Francisco, California, Metallica’s hometown and a possible host city for Super Bowl LX.

When Did It Take Place?

Lars Ulrich’s comments were made recently, with Super Bowl LX scheduled for February 2026.

How Is It Unfolding?

– Lars Ulrich calls the idea a “dream come true” during an interview.

– Speculation mounts as San Francisco is a potential Super Bowl LX host city.

– Fans reminisce about The Who’s 2010 halftime show, the last rock performance.

– NFL and halftime show producers remain tight-lipped on future plans.

Quick Breakdown

– Metallica hasn’t performed at the Super Bowl halftime show before.

– San Francisco last hosted the Super Bowl in 2016 (Super Bowl 50).

– Rock music has been absent from the halftime stage since 2010.

– Ulrich’s comments spark a wave of nostalgia and hope among fans.

Key Takeaways

Metallica’s potential Super Bowl LX performance would mark a historic moment, bridging the gap between rock music and mainstream American sports culture. It’s been over a decade since a rock band performed at the halftime show, making this a huge deal for fans. San Francisco as the host city adds a personal touch, linking the band to their roots. If realized, this could revitalize the halftime show’s musical diversity and draw in a broader audience.

“I can only imagine the energy Metallica would bring to the Super Bowl—it would be a game-changer, literally.”

– Dave Navarro, Guitarist and Musician

Final Thought

If Metallica takes the Super Bowl LX stage, it won’t just be a performance—it’ll be a cultural moment. Picture the thundering bass, the explosive drums, and Lars Ulrich’s infectious energy filling Levi’s Stadium. This isn’t just about music; it’s about nostalgia, homecoming, and the power of rock ‘n’ roll crashing into mainstream sports. Whether it happens or not, the excitement alone shows how much fans crave a rock revival in the spotlight.