Natural Disasters

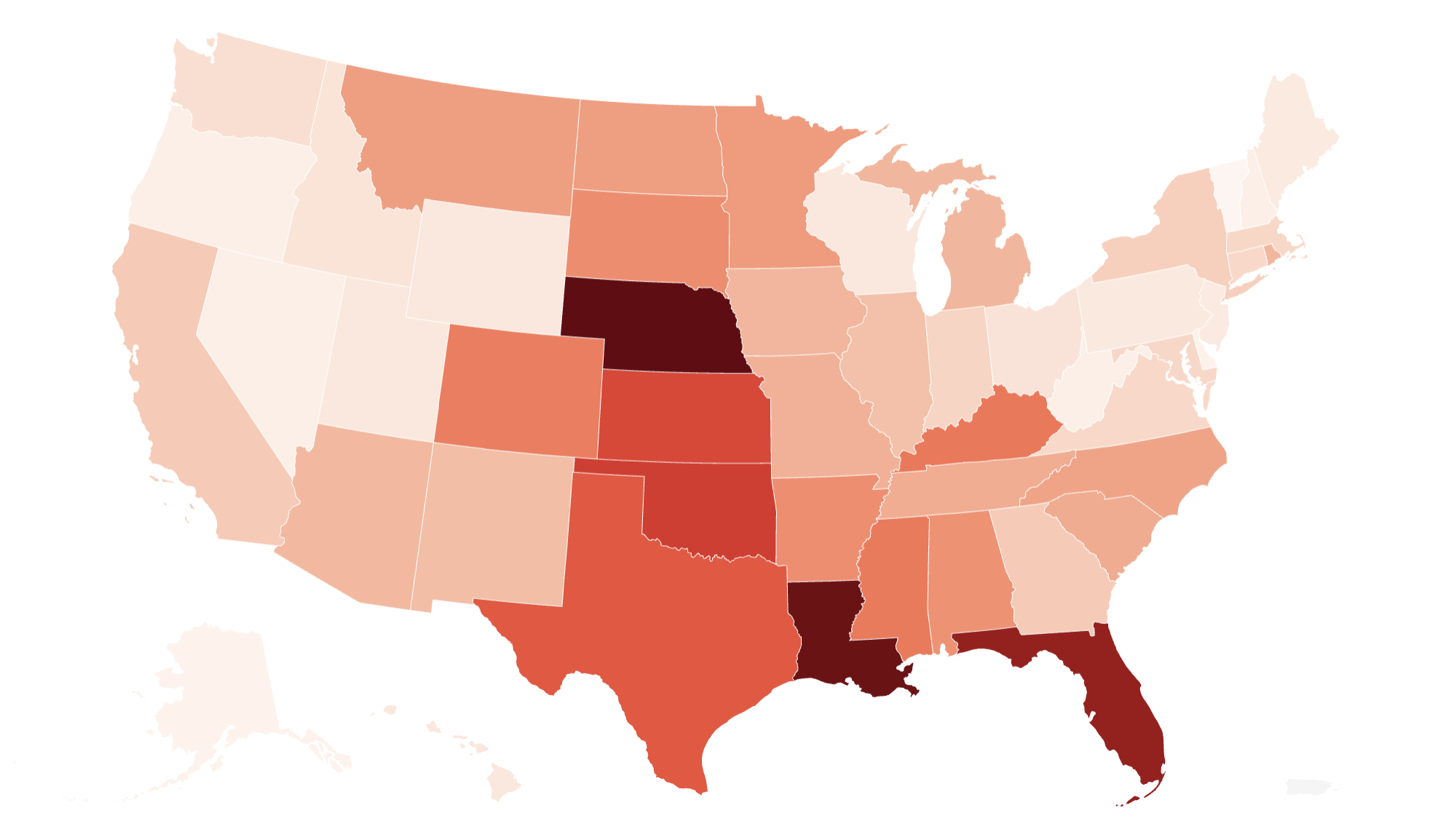

Map Shows Where Home Insurance Costs Most-and Least

Here’s the rewritten article in the requested structured HTML format:

—

**Rising Home Insurance Costs: Which States Are Feeling the Pain?**

What’s Happening?

Home insurance costs are soaring across the U.S., with Americans allocating a larger portion of their income toward protection against natural disasters. Climate change and frequent severe weather events are driving up prices, leaving homeowners grappling with higher financial burdens.

Where Is It Happening?

The rising costs are most acute in disaster-prone regions, particularly in states like Florida, California, and Texas, where hurricanes, wildfires, and floods are increasingly common.

When Did It Take Place?

This trend has been steadily worsening over the past decade, with homeowners reporting significant premium increases in the last few years.

How Is It Unfolding?

- Insurance companies are raising premiums due to increased claims from natural disasters.

- Some insurers are withdrawing from high-risk areas, leaving homeowners with fewer options.

- Governments are exploring subsidies or state-run insurance programs to fill the gap.

- Homeowners are turning to mitigation strategies, like storm-resistant construction, to lower costs.

- Advocacy groups are pushing for policy reforms to make insurance more affordable.

Quick Breakdown

- Florida, California, and Texas among the hardest-hit states.

- Premiums have risen by up to 30% in high-risk zones.

- Climate change exacerbates weather-related insurance claims.

- Fewer insurers are offering coverage in disaster-prone areas.

Key Takeaways

The escalating cost of home insurance reflects the broader challenge of climate change, where homeowners in vulnerable regions face shrinking options and higher financial strain. As insurance becomes unaffordable, communities must adapt through policy changes, mitigation efforts, and government intervention to ensure protection remains within reach.

Without systemic changes, homeowners in at-risk areas will continue to bear the brunt of climbing insurance costs, further straining the housing market and local economies.

– Sarah Reynolds, Climate Policy Analyst

Final Thought

Home insurance is no longer just a financial safeguard—it’s a growing financial burden for many Americans. As climate risks accelerate, policymakers and insurers must collaborate to create sustainable solutions that protect homeowners without breaking the bank.

**

Source & Credit: https://www.newsweek.com/map-shows-where-home-insurance-costs-most-least-2120635