Inflation

Tariffs Dominate Earnings Calls on Wall Street

**Wall Street CEOs Sound Alarms on Tariff Impact in Earnings Calls**

“`html

What’s Happening?

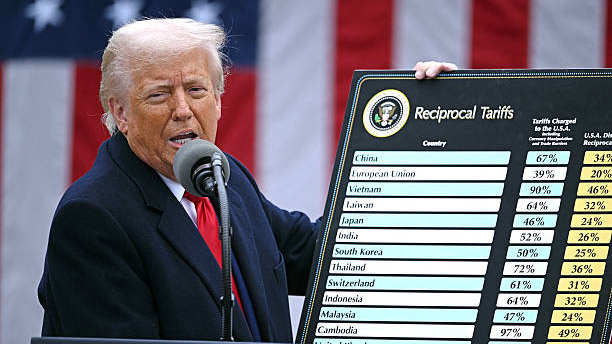

Tariffs are taking center stage in Wall Street’s earnings calls, overshadowing inflation as CEOs grapple with the financial fallout from global trade tensions. With over 80% of the S&P 500 reporting second-quarter earnings, the focus is squarely on how these new tariffs are reshaping business strategies and financial forecasts.

Where Is It Happening?

The impact is being felt across the U.S. and globally, as tariffs affect supply chains, consumer prices, and corporate profitability.

When Did It Take Place?

These developments are unfolding during the second-quarter earnings season.

How Is It Unfolding?

- CEOs are highlighting the need for price adjustments to offset tariff costs, likely leading to higher consumer prices.

- Companies are reviewing their global supply chains to mitigate the financial burden.

- Analysts are questioning the long-term viability of current business models under the new tariff regime.

- Inflation concerns are being sidelined as tariffs dominate financial projections.

Quick Breakdown

- Over 80% of S&P 500 companies have reported Q2 earnings, with tariffs as the top concern.

- Tariffs are reshaping supply chains and pricing strategies across industries.

- Investors and analysts are closely monitoring how tariffs will impact future earnings.

Key Takeaways

Tariffs are redefining the corporate landscape, forcing companies to adapt quickly or risk falling behind. The shift away from inflation worries to tariff-driven changes highlights the immediate and severe impact of global trade policies on business operations. As CEOs navigate these challenges, the focus on tariffs is a clear sign that the economic environment is evolving rapidly, requiring agility and strategic foresight.

“The new tariff landscape is a game-changer, and companies that fail to adapt will face significant financial repercussions.”

– Sarah Chen, Economic Analyst at Global Insights Group

Final Thought

As tariffs dominate earnings calls, the corporate world is at a crossroads. Companies must swiftly adjust their strategies to mitigate financial damage, while investors keep a keen eye on the long-term implications of these trade policies. The situation is fluid, and the ability to pivot will determine which companies thrive and which ones struggle in this new economic climate.

“`

Source & Credit: https://www.bloomberg.com/news/videos/2025-08-08/tariffs-dominate-earnings-calls-on-wall-street

-

New York1 week ago

New York1 week agoYankees’ Aaron Boone Makes Cody Bellinger Statement After Aaron Judge Injury

-

New York5 days ago

New York5 days agoToday in History: Investigation into Andrew Cuomo released

-

New York6 days ago

New York6 days agoSmall quake shakes the New York area. USGS says magnitude was 3.0

-

Chicago6 days ago

Chicago6 days agoESPN Provides Strong Response After Chicago Sky Pushed To ‘Shut Down’ Angel Reese

-

Austin6 days ago

Austin6 days agoWho Is Austin Drummond? What to Know About Quadruple Homicide Suspect

-

Houston5 days ago

Houston5 days agoWhy isn’t Dustin May starting on Sunday for the Red Sox?

-

Houston5 days ago

Houston5 days agoCJ Stroud’s Mom Shows Uplifting Gesture to Houston Women After Sharing Texans QB’s Struggle

-

Chicago4 days ago

Chicago4 days agoChicago Sky HC Makes Dissatisfaction Clear Amid 1-10 WNBA Collapse in Angel Reese’s Absence