Cybersecurity

This cybersecurity stock could be good for 22% upside from here, says Bank of America

Cybersecurity Stock Poised for 22% Upswing, Says Bank of America

What’s Happening?

Bank of America has upgraded Palo Alto Networks’ stock to “buy,” projecting a 22% potential upside. The firm reiterated its $215 price target, citing improved long-term prospects in the cybersecurity sector as a key catalyst for growth.

Where Is It Happening?

This development is centered in the financial markets, primarily impacting investors and stakeholders of Palo Alto Networks.

When Did It Take Place?

The upgrade was announced on Tuesday, setting the stage for potential market shifts in 2025.

How Is It Unfolding?

– Bank of America’s analysis highlights Palo Alto Networks’ robust market position.

– The cybersecurity sector is expected to see significant growth drivers.

– Shares have dipped over 3% in 2025, presenting a buying opportunity.

– Investors are eyeing the stock for its long-term value proposition.

Quick Breakdown

– Palo Alto Networks stock upgraded from neutral to buy by Bank of America

– Price target set at $215 per share, indicating a 22% upside.

– Cybersecurity market growth is a key driver for the stock’s potential.

– Current share price decline presents an attractive entry point for investors.

Key Takeaways

Bank of America’s upgrade of Palo Alto Networks to a “buy” rating signals confidence in the company’s future performance. With a 22% potential upside and a strong market position, now might be the perfect time for investors to consider adding this cybersecurity stock to their portfolios. The firm’s analysis suggests that the current market conditions and long-term growth prospects make Palo Alto Networks a compelling investment opportunity.

“Palo Alto Networks’ innovation and market presence position it as a leader in cybersecurity, making it a must-watch for investors.”

– Sarah Chen, Chief Cybersecurity Analyst

Final Thought

Bank of America’s upgraded rating for Palo Alto Networks underscores its potential for significant growth amidst a thriving cybersecurity landscape. As shares dip, investors could capitalize on the opportunity to secure a stake in a company poised for long-term success. With a conservative 22% upside and a strong market footprint, Palo Alto Networks stands out as a strategic investment in an increasingly digital world.

Source & Credit: https://www.cnbc.com/2025/08/19/this-cybersecurity-stock-could-be-good-for-22percent-upside-from-here-says-bank-of-america-.html

Cybersecurity

Hacking AI Agents-How Malicious Images and Pixel Manipulation Threaten Cybersecurity

Cybersecurity

Colorado Springs tech firm TeKnowledge laying off more than 300 employees

Cybersecurity

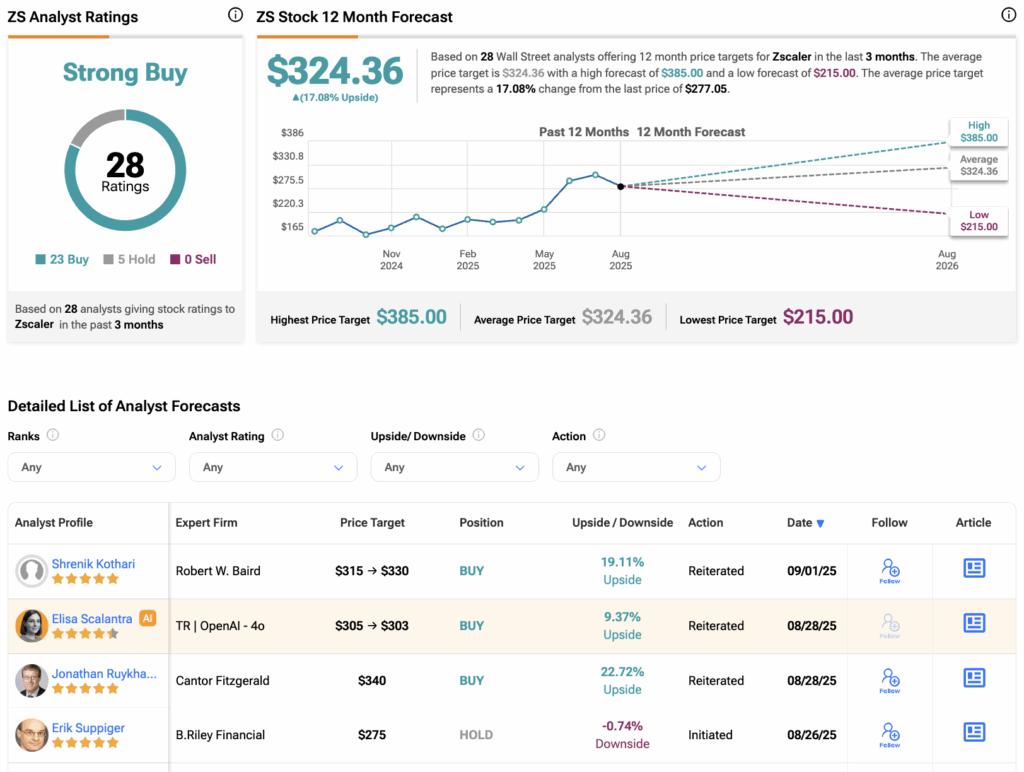

Here’s Why Morgan Stanley Turned Bullish on Zscaler Stock (ZS) Ahead of Earnings

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk’s Tesla To Offer Grok, ChatGPT Rival DeepSeek, ByteDance’s Doubao With Its Cars In China

-

News2 weeks ago

News2 weeks agoDeadpool VR offers chaotic fighting with silly jokes

-

News2 weeks ago

News2 weeks agoBlack Myth: Zhong Kui

-

GPUs2 weeks ago

GPUs2 weeks agoNvidia RTX 50 SUPER GPU rumors: everything we know so far

-

NASA7 days ago

NASA7 days agoNASA Makes Major Discovery Inside Mars

-

Entertainment1 week ago

‘Big Brother 27’ Contestant Rylie Jeffries Breaks Silence on Katherine Woodman Relationship

-

News7 days ago

News7 days ago5 Docker containers I use to manage my home like a pro

-

NASA7 days ago

NASA7 days agoNASA Peers Inside Mars And Discovers A Mysteriously Violent Martian Past