News

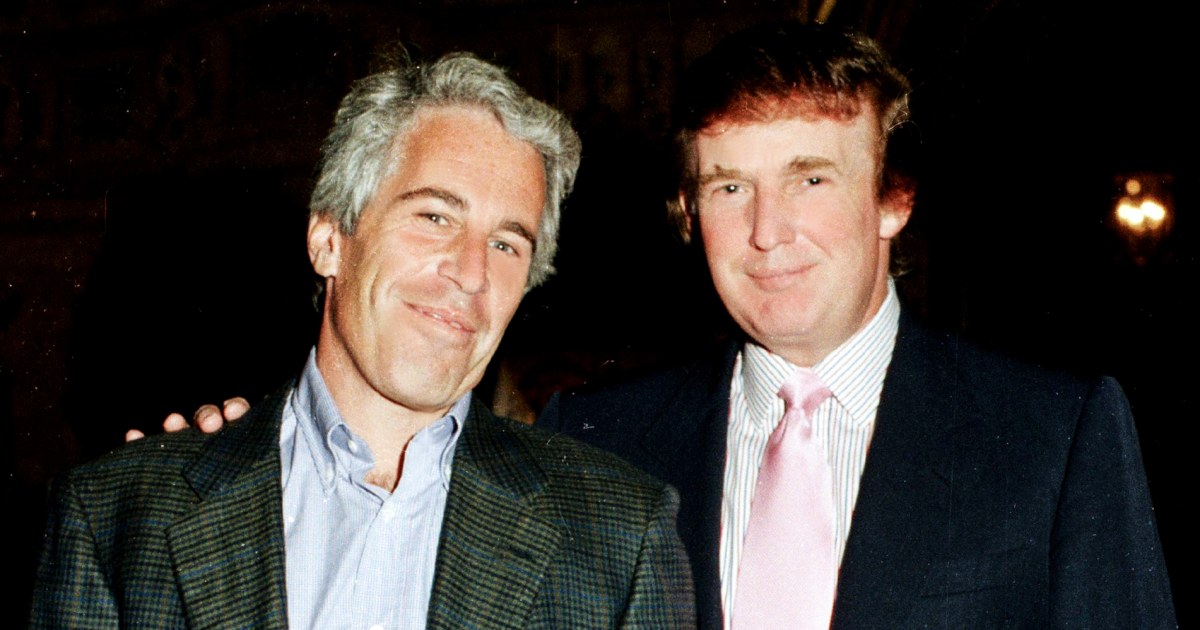

Trump denies writing letter to Jeffrey Epstein with drawing of a naked woman

Trump Denies Crude Birthday Letter to Jeffrey Epstein

Rolling Stone, Harrowing Birthday Letters

Those who have helped get above existence today. In February 2003, a not-quite-elite list completed 112 letters to Jeffrey Epstein, a man once thought a backroom diplomat with a Five-star lifestyle: “He gave a new meaning to making children believe in Gifts from Santa”. Yet, today, Epstein is known for the tragedies he caused; The nude birthday letter begs a certainty of an important question: “Was Trump just another Wolf?”

What’s Happening?

President Trump denied writing a peculiar letter to Jeffrey Epstein, filled with a nude woman with a “Donald” signature.

Where Is It Happening?

United States.

When Did It Take Place?

February 2003.

How Is It Unfolding?

–

–

–

–

Quick Breakdown

–

–

–

–

Key Takeaways

The Wall Street Journal’s report about Trump’s involvement with Epstein’s birthday letter has added a new twist to their already controversial relationship. The letter in question, which is somehow even more “controversial” than a note of the same mass most of us write to our fathers, contains a revealing signature that Trump has emphatically denied writing. The situation highlights Trump’s willingness to confront the media head-on, as he has threatened to sue the newspaper. Whether other associates named in the letters will face scrutiny remains to be seen. Finally, for all the innocent citizens, alive in the castigation by Epstein: Investigate the question- “Was Trump blind to the crimes?”

Then, it’s very clear from the way he behaved with Epstein and with others that he really does have trying for the lives of people(common people and associates) will only worsen.

– Former Federal Prosecutor

Final Thought

Trump’s denial of involvement in the Epstein birthday letter highlights the ongoing controversy surrounding their relationship. The threat of a lawsuit against the Wall Street Journal escalates the situation: he has a history of fining, discrediting! As we wait for more information to surface: Increasing investing in what YOU want will be ours and not theirs! Key takeaway: Stay informed and hold powerful figures accountable. An unjustified level of warped justice over 30 Years ago, not once, but MULTIPLE TIMES. “Show me the money!”