News

TSLA vs. RIVN: Which EV Stock Is a Better Buy for Long-Term Gains?

**Tesla vs. Rivian: Long-Term EV Investment Showdown**

What’s Happening?

The electric vehicle (EV) revolution is in full swing, with Tesla and Rivian at the forefront of this transformative shift in transportation. Investors are evaluating which stock holds more promise for long-term growth as both companies vie for dominance in the rapidly expanding EV market.

Where Is It Happening?

This showdown is playing out globally, with Tesla having a strong presence in the U.S., Europe, and Asia, while Rivian is focused on the American market, particularly with its adventurous and luxury-oriented vehicles.

When Did It Take Place?

The competition has been ongoing for years, but recent developments and market trends have intensified the debate over which company will lead the EV future.

How Is It Unfolding?

– Tesla continues to innovate with new models like the Cybertruck and ongoing advancements in battery technology.

– Rivian has gained traction with its R1T pickup truck and R1S SUV, attracting high-profile investors.

– Both companies are expanding their charging infrastructure to support widespread EV adoption.

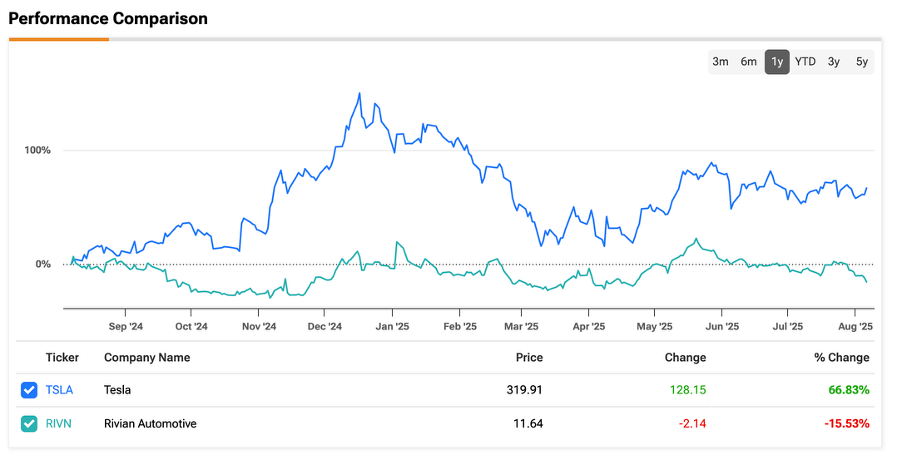

– Tesla’s stock has seen volatility, while Rivian’s shares have fluctuated amid production challenges.

Quick Breakdown

– Tesla has a proven track record and a broad product lineup.

– Rivian offers niche, high-performance vehicles and strong brand appeal.

– Tesla’s Supercharger network provides a competitive edge in charging infrastructure.

– Rivian’s focus on adventure-friendly EVs could tap into a growing market segment.

Key Takeaways

The Tesla vs. Rivian debate centers on experience versus innovation. Tesla’s long-standing market presence and extensive infrastructure provide stability, while Rivian’s fresh approach and niche offerings could carve out a unique position in the EV market. Investors must weigh the proven success of Tesla against the disruptive potential of Rivian’s bold vision.

The EV market is ripe for both established leaders and visionary newcomers. The real winners will be those who can balance innovation with execution.

– Elara Voss, Automotive Analyst

Final Thought

In this EV showdown, Tesla offers tried-and-true strength, while Rivian brings a fresh perspective. Investors must consider long-term strategy, market trends, and the evolving consumer preferences that will shape the future of electric vehicles. The race is far from over, and both companies have the potential to leave their mark on the road ahead.

Source & Credit: https://markets.businessinsider.com/news/stocks/tsla-vs-rivn-which-ev-stock-is-a-better-buy-for-long-term-gains-1035004508