News

What drives financial fraud? It can come down to one emotion

Unraveling the Psychology Behind Financial Fraud

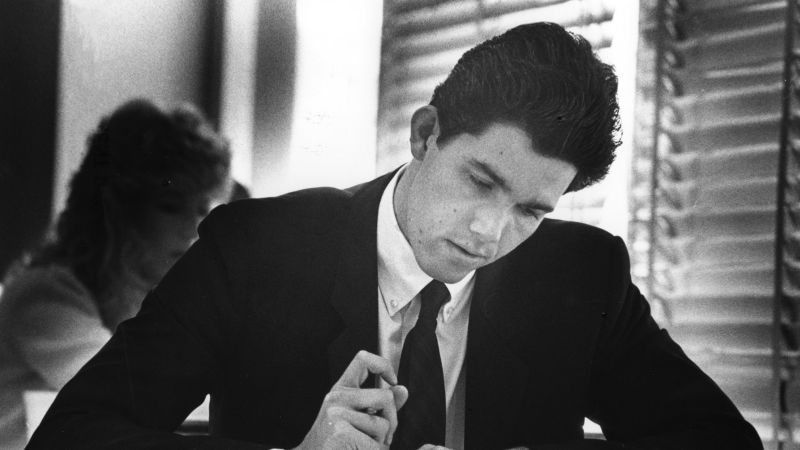

What drives an individual to risk everything in a high-stakes poker game with other people’s money? In this high-risk, high-reward game, can the human mindset predict the volatile flow of money? Managed shrewd hunger for more may overthrow ethical decisions and lead to significant financial fraud.

What’s Happening?

Financial fraud, often driven by greed, continues to plague markets, with schemes evolving and lingering risks challenging investors and regulators.

Where Is It Happening?

Financial fraud is a global phenomenon, with recent high-profile cases in the US, UK, and Asia. It affects both traditional financial markets and emerging sectors like cryptocurrency.

When Did It Take Place?

Greed-fueled fraud has been persistent throughout market history, with recent cases emerging amid economic uncertainty post-pandemic.

How Is It Unfolding?

- Ponzi Schemes 2.0: Modern twists on classic scams, leveraging digital currencies and social media.

- Exotic Investments: Fraudsters push unregulated, complex products promising unrealistic returns.

- Insider Trading Ring: Customer data and machine learning are used to predict and exploit market trends.

- Regulatory Whack-a-Mole: As authorities shut down one scheme, others pop up elsewhere, often globally.

Quick Breakdown

- Greed is a persistent motivator in financial fraud, often clouding ethical decision-making.

- Global connectivity and digital innovation have broadened the scope and scale of fraud.

- Post-pandemic economic uncertainty has created fertile ground for scams.

- Regulators struggle to keep pace with evolving fraud tactics.

Key Takeaways

The age-old problem of greed can spark fraudulent behavior that has serious consequences for everyone. When faced with these decisions, understanding the red flags and educating yourself with financial-insolvency signs can help people to reduce these risks.

“The allure of quick riches can blind us to the risks and consequences of our actions. It’s crucial to cultivate a healthy skepticism towards ‘too good to be true’ investment opportunities.”

– Dr. Jane Silva, Behavioral Economist

Final Thought

Unchecked greed is a destructive force in the world of finance. Despite the best efforts of regulatory these organizations, successful fraud can take a heavy burden on their wallets. Investigating these scams is important in order to protect our financial future.