Price-to-Earnings Ratio: Definition, Calculation, and Application in Investing

When it comes to analyzing a company’s financial health, one of the most commonly used metrics is the price-to-earnings ratio, or PE ratio for short. The PE ratio is a tool that investors use to determine how much they are willing to pay for a company’s earnings. In this article, we will explore the ins and outs of the PE ratio, including what it is, how to calculate it, and what it means for investors.

What is the PE Ratio?

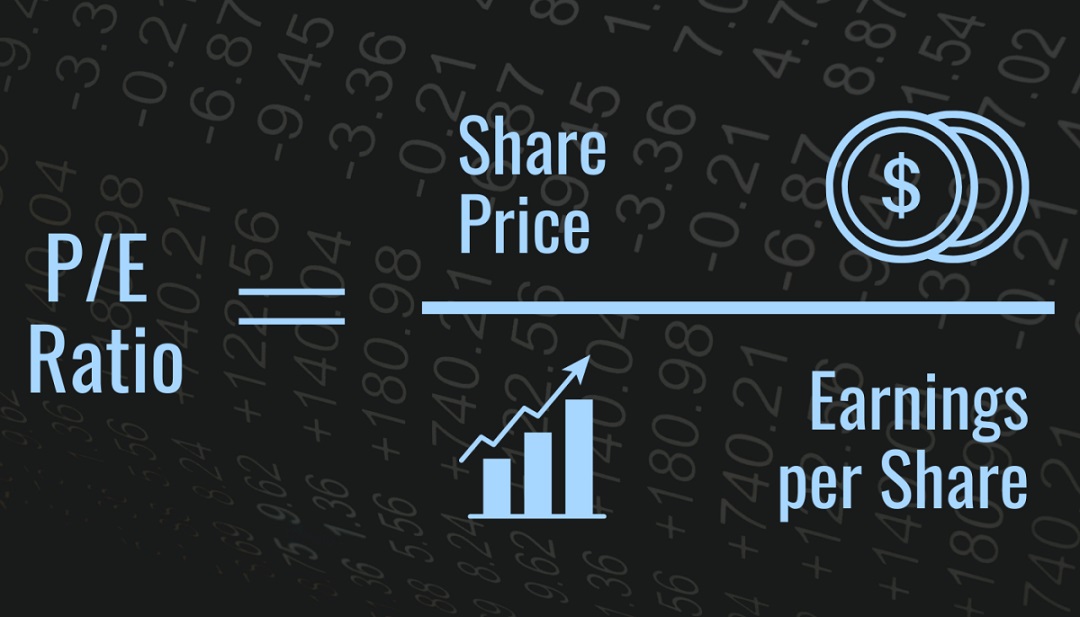

The PE ratio is a measure of a company’s stock price relative to its earnings. It is calculated by dividing the current market price per share of a stock by its earnings per share (EPS). In essence, the PE ratio tells investors how much they are paying for each dollar of a company’s earnings.

How to Calculate the PE Ratio?

The formula for calculating the PE ratio is simple. All you need is the stock’s current market price and its EPS. To calculate the PE ratio, divide the stock’s market price per share by its EPS. For example, if a stock is currently trading at $50 per share and its EPS is $5, its PE ratio would be 10 ($50/$5).

The formula to calculate the Price-to-Earnings (P/E) ratio is:

P/E Ratio = Market Value per Share / Earnings per Share (EPS)

For example, if a company has a market value per share of $50 and an EPS of $2, the P/E ratio would be:

P/E Ratio = $50 / $2 = 25

This means that investors are willing to pay $25 for every $1 of earnings generated by the company. The P/E ratio can be interpreted in different ways, depending on the industry, company size, and growth prospects. A high P/E ratio may indicate that the market expects strong earnings growth in the future, while a low P/E ratio may suggest that the company is undervalued or faces challenges in generating profits.

Types of PE Ratios

There are two types of PE ratios: forward PE ratios and trailing PE ratios. A forward PE ratio is calculated by dividing the current stock price by the estimated earnings per share for the next 12 months. A trailing PE ratio, on the other hand, is calculated by dividing the current stock price by the actual earnings per share for the past 12 months.

Understanding the PE Ratio

The PE ratio is a widely used metric because it provides a quick snapshot of a company’s financial health. However, it is important to remember that the PE ratio is just one piece of the puzzle. It should be used in conjunction with other financial metrics to gain a more complete understanding of a company’s financial health.

For example, a company with a high PE ratio may be overvalued if its earnings growth is slowing down. Conversely, a company with a low PE ratio may be undervalued if its earnings growth is accelerating.

The PE ratio can also vary widely across industries. For example, technology companies often have higher PE ratios than companies in the manufacturing sector. This is because technology companies are expected to grow faster and generate higher earnings in the future.

Interpreting the PE Ratio

Interpreting the PE ratio requires some context. A high PE ratio can indicate that investors are optimistic about a company’s future earnings growth. On the other hand, a low PE ratio can indicate that investors are not as confident in a company’s future earnings growth.

However, a high or low PE ratio does not necessarily mean that a company’s stock is overvalued or undervalued. It is important to consider other factors, such as the company’s growth prospects, industry trends, and competition.

Limitations of the PE Ratio

While the PE ratio is a useful metric, it has some limitations. For example, the PE ratio does not take into account a company’s debt, which can significantly affect its financial health. Additionally, the PE ratio can be skewed by one-time events, such as a large write-off or a significant one-time gain.

Conclusion

The PE ratio is a widely used metric that can provide valuable insights into a company’s financial health. However, it should be used in conjunction with other financial metrics to gain a more complete understanding of a company’s financial health. Investors should also be aware of the limitations of the PE ratio and use it in context with other factors to make informed investment decisions.