What is Commercial CIBIL Score and How Does it Affect Your Business?

Introduction

- Definition of Commercial CIBIL Score

- Importance of maintaining a good commercial CIBIL score

- Purpose of the article

What is Commercial CIBIL Score?

- Explanation of Commercial CIBIL Score

- Difference between Personal and Commercial CIBIL Score

- Factors that determine Commercial CIBIL Score

Importance of Commercial CIBIL Score

- How lenders use Commercial CIBIL Score

- Importance of Commercial CIBIL Score for businesses

- Factors that affect Commercial CIBIL Score

Benefits of a Good Commercial CIBIL Score

- Favorable Loan Terms

- Access to More Financing Options

- Competitive Interest Rates

Consequences of a Poor Commercial CIBIL Score

- Difficulty in getting loans

- Higher interest rates

- Unfavorable loan terms

How to Improve Your Commercial CIBIL Score

- Steps to improve Commercial CIBIL Score

- How long it takes to improve Commercial CIBIL Score

- How to maintain a good Commercial CIBIL Score

Conclusion

- Recap of key points

- Importance of maintaining a good Commercial CIBIL Score

Introduction

As a business owner, it’s important to understand your company’s creditworthiness and how it affects your ability to obtain financing. One of the critical factors that determine a business’s creditworthiness is its Commercial CIBIL Score. In this article, we will explain what Commercial CIBIL Score is, how it affects your business, and what you can do to maintain a good Commercial CIBIL Score.

What is Commercial CIBIL Score?

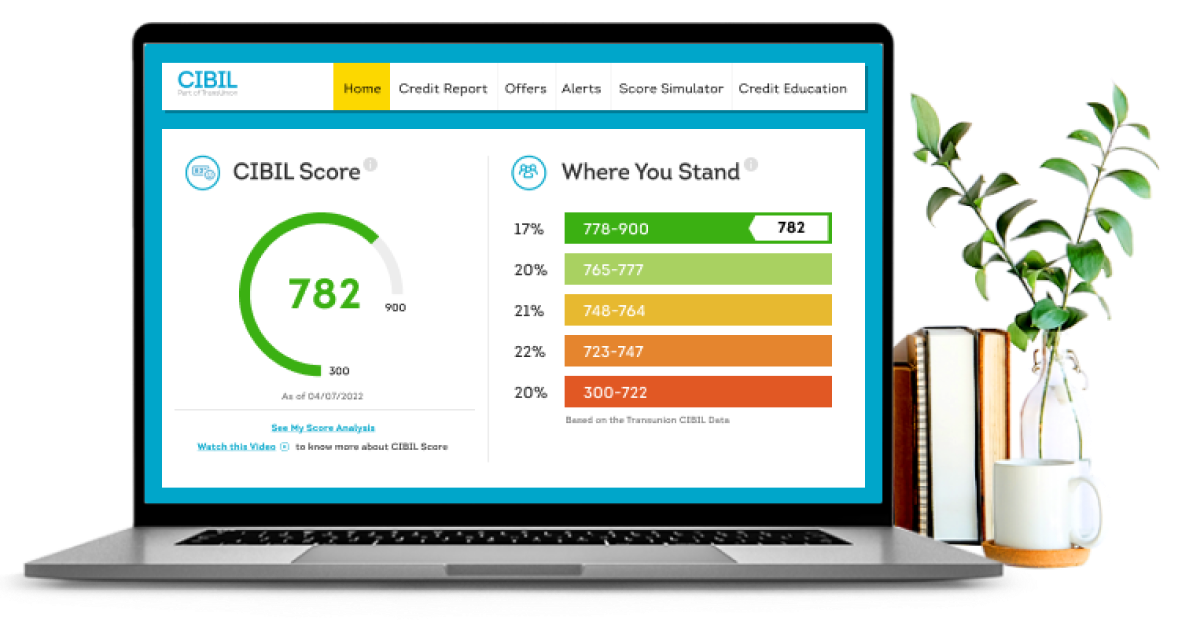

Commercial CIBIL Score is a three-digit number that represents the creditworthiness of a business. It is a crucial factor that lenders consider when evaluating loan applications from businesses. A good Commercial CIBIL Score indicates that the business is financially responsible and is likely to repay the loan on time. On the other hand, a poor Commercial CIBIL Score can make it difficult for a business to secure funding.

Unlike a personal CIBIL Score, which ranges from 300 to 900, the Commercial CIBIL Score has a different range. The Commercial CIBIL Score ranges from 1 to 5, with 1 being the highest score possible. A score of 1 indicates that the business has an excellent credit history, while a score of 5 indicates that the business has a poor credit history.

Factors that Determine Commercial CIBIL Score

Several factors determine a business’s Commercial CIBIL Score, including payment history, credit utilization, credit mix, and length of credit history. Payment history and credit utilization are the most significant factors that impact the score.

Payment History: The payment history includes information on the payment of the business’s outstanding debts. Late payments, missed payments, or default on loans will negatively impact the Commercial CIBIL Score.

Credit Utilization: Credit utilization is the ratio of the business’s credit balance to its credit limit. Lenders prefer businesses that use less than 30% of their available credit limit.

Credit Mix: Credit mix is the variety of credit accounts a business has, such as loans, credit cards, and lines of credit. A mix of different types of credit accounts can positively impact the Commercial CIBIL Score.

Length of Credit History: The length of credit history is the age of the business’s oldest credit account. A long credit history can positively impact the Commercial CIBIL Score.

Importance of Commercial CIBIL Score

How Lenders Use Commercial CIBIL Score

Lenders use Commercial CIBIL Score to determine the creditworthiness of a business. A high Commercial CIBIL Score indicates that the business is financially responsible and is likely to repay the loan on time. Lenders prefer to lend to businesses with good Commercial CIBIL Scores, as it reduces the risk of default.

When a business applies for a loan, lenders evaluate the Commercial CIBIL Score along with other factors like the business’s revenue, profitability, and cash flow. If the Commercial CIBIL Score is high, the lender is likely to approve the loan application and offer favorable loan terms, such as a low-interest rate, longer repayment period, or higher loan amount.

On the other hand, if the Commercial CIBIL Score is low, the lender may reject the loan application or offer unfavorable loan terms, such as a high-interest rate, shorter repayment period, or lower loan amount. A low Commercial CIBIL Score indicates that the business has a history of late payments, missed payments, or default on loans, which increases the risk of default.

Importance of Commercial CIBIL Score for Businesses

Maintaining a good Commercial CIBIL Score is critical for businesses, as it affects their ability to obtain financing. A good Commercial CIBIL Score opens up more financing options and ensures that businesses can access funding when needed. It also enables businesses to negotiate favorable loan terms and get competitive interest rates.

A good Commercial CIBIL Score also signals that the business is financially responsible and has a good credit history. This reputation can help businesses build trust with lenders, suppliers, and customers, which can lead to more business opportunities and growth.

Factors that Affect Commercial CIBIL Score

Several factors can affect a business’s Commercial CIBIL Score, including late payments, missed payments, default on loans, high credit utilization, and recent credit inquiries. These factors can negatively impact the Commercial CIBIL Score and make it difficult for businesses to obtain financing.

Late Payments and Missed Payments: Late payments and missed payments can have a significant impact on the Commercial CIBIL Score. Late payments stay on the business’s credit report for up to seven years and can reduce the Commercial CIBIL Score by several points.

Default on Loans: Defaulting on a loan can severely damage the Commercial CIBIL Score. Defaulted loans stay on the business’s credit report for up to seven years and can reduce the Commercial CIBIL Score by several points.

High Credit Utilization: High credit utilization can negatively impact the Commercial CIBIL Score. Lenders prefer businesses that use less than 30% of their available credit limit.

Recent Credit Inquiries: Recent credit inquiries can negatively impact the Commercial CIBIL Score. Lenders may view multiple credit inquiries as a sign of financial distress and may be hesitant to lend to businesses with a high number of credit inquiries.

Benefits of a Good Commercial CIBIL Score

Maintaining a good Commercial CIBIL Score can provide several benefits to businesses, including favorable loan terms, access to more financing options, and competitive interest rates.

Favorable Loan Terms: A good Commercial CIBIL Score enables businesses to negotiate favorable loan terms, such as a low-interest rate, longer repayment period, or higher loan amount.

Access to More Financing Options: Maintaining a good Commercial CIBIL Score opens up more financing options for businesses. Lenders prefer to lend to businesses with good Commercial CIBIL Scores, which increases the chances of getting approved for a loan.

Competitive Interest Rates: A good Commercial CIBIL Score ensures that businesses can get competitive interest rates on their loans. This can save businesses a significant amount of money in interest payments over the life of the loan.

Consequences of a Poor Commercial CIBIL Score

A poor Commercial CIBIL Score can have several consequences for businesses, including difficulty in obtaining financing, higher interest rates, and unfavorable loan terms.

Difficulty in Obtaining Financing: Businesses with poor Commercial CIBIL Scores may find it challenging to obtain financing. Lenders may be hesitant to lend to businesses with a history of late payments, missed payments, or default on loans, as it increases the risk of default.

Higher Interest Rates: A poor Commercial CIBIL Score can result in higher interest rates on loans. Lenders charge higher interest rates to businesses with poor credit scores to compensate for the increased risk of default.

Unfavorable Loan Terms: Businesses with poor Commercial CIBIL Scores may be offered unfavorable loan terms, such as a shorter repayment period, lower loan amount, or higher collateral requirements.

How to Improve Commercial CIBIL Score

Businesses can take several steps to improve their Commercial CIBIL Scores, including making timely payments, keeping credit utilization low, monitoring credit reports regularly, and resolving any errors or disputes in the credit report.

Making Timely Payments: Making timely payments on loans and credit cards is essential for maintaining a good Commercial CIBIL Score. Late payments and missed payments can have a significant impact on the Commercial CIBIL Score and can stay on the credit report for up to seven years.

Keeping Credit Utilization Low: Businesses should aim to use less than 30% of their available credit limit to maintain a good Commercial CIBIL Score. High credit utilization can negatively impact the Commercial CIBIL Score and can make it difficult to obtain financing.

Monitoring Credit Reports Regularly: Businesses should monitor their credit reports regularly to ensure that all the information is accurate and up-to-date. Any errors or disputes in the credit report should be resolved immediately to avoid any negative impact on the Commercial CIBIL Score.

Conclusion

In conclusion, the Commercial CIBIL Score is an essential factor that lenders use to evaluate the creditworthiness of businesses. Maintaining a good Commercial CIBIL Score is critical for businesses to access financing when needed, negotiate favorable loan terms, and get competitive interest rates. Factors that can negatively impact the Commercial CIBIL Score include late payments, missed payments, default on loans, high credit utilization, and recent credit inquiries. Businesses can improve their Commercial CIBIL Scores by making timely payments, keeping credit utilization low, monitoring credit reports regularly, and resolving any errors or disputes in the credit report. By maintaining a good Commercial CIBIL Score, businesses can build trust with lenders, suppliers, and customers, and open up more opportunities for growth and success.